The Fed has recently released the hypothetical scenarios for its 2023 supervisory stress test, explains Avi Gilburt of ElliotWaveTrader.net.

This test is conducted annually to show how the banks are likely to perform in a recessionary environment. The results of this test under the "supervisory severely adverse scenario" are used to set capital requirements for large banks.

In this article, we will take a look at the assumptions for the 2023 stress test and also discuss which crucial areas of the US banks are still being overlooked and are not being tested by the Fed. In our view, the current stress tests conducted by the regulator do not reflect the actual financial conditions of the US banks under a sharp recession scenario.

First, it is important to note that the new assumptions are not that different relative to the previous year if we look at general trends.

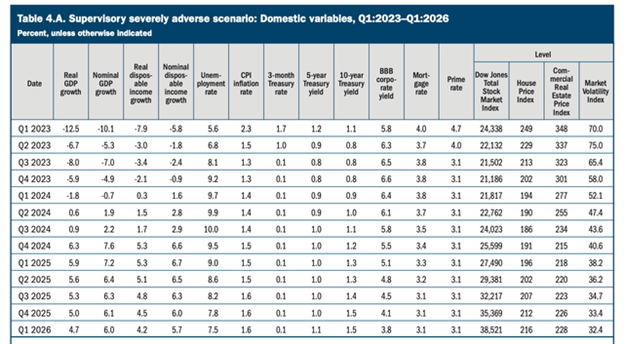

Under the 2023 severely adverse scenario, the US unemployment rate rises to a peak of 10% in the 3Q24, which implies an increase of 6.5 percentage points compared to the level of the 4Q22. Last year, the Fed assumed a 5.75 percentage points increase in the unemployment rate; however, the peak was the same at 10%.

The 2023 scenario also features a significantly higher starting level of interest rates, given that they increased last year.

In the 2023 scenario, house prices fall by 38% (compared to 28.5% in the 2022 scenario), while commercial real estate prices decline by 40% (unchanged relative to the previous year’s scenario). A sharper decline in house prices is also due to a higher starting point, as house prices posted growth in 2022. So, while this may seem like a change, it really is not.

Notably, the key assumptions for asset markets, such as equity prices and an increase in corporate bond spreads, are now less severe. Under the 2023 scenario, the spread between yields on BBB-rated bonds and yields on ten-year Treasury securities widens to 5.75% in 3Q23, implying an increase of 3.5 percentage points relative to 4Q22. From 4Q22 to 4Q23, equity prices fell by 45%. By comparison, the 2022 scenario featured a 4.75 percentage points increase in corporate bond spreads and a 55% decline in equity prices. While new assumptions for asset markets are also due to the new starting points, we note that the 2023 scenario for this area looks less severe compared to 2022.

The Fed

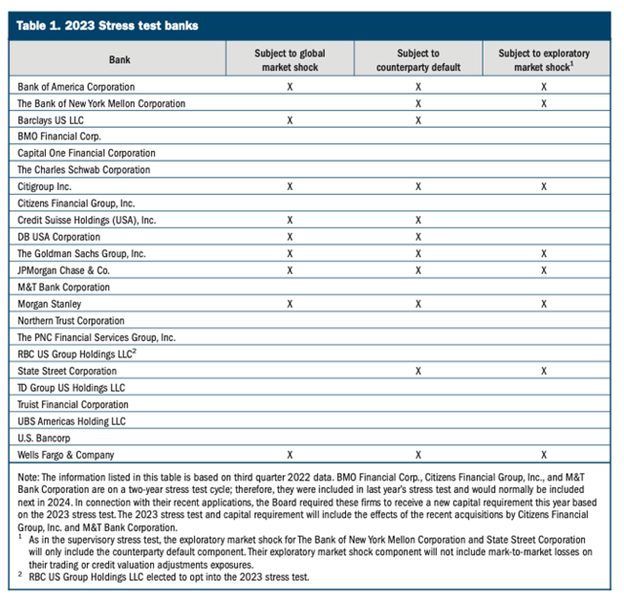

Below, we would like to discuss several crucial areas that, in our view, are still being overlooked by the Fed’s stress tests. Estimation of trading losses requires a more conservative approach.

The share of securities on the bank’s balance sheets is quite large, and for some of them, securities represent almost 40% of their total assets. Some banks have exposure to equities, including non-US ones, but the largest part of securities is US bonds, municipal bonds, and corporate bonds. Under its "severely adverse scenario," the Fed assumes that short-term rates will fall to zero while longer-term rates, measured as the ten-year Treasury yield, will decline below 1%. As a result, banks will record revaluation gains from securities, which sit on their balance sheets. These gains will almost certainly compensate for any losses in equities, given that the share of equities for most banks is smaller.

In our previous reports on large US banks, we mentioned that longer-term bonds could lead to huge losses for a bank in a rising rate environment. It seems that the Fed is beginning to realize that its current stress tests do not estimate potential trading losses conservatively. This year, for the first time, the Fed will publish an additional, exploratory market shock component. According to the regulator, the exploratory market shock is characterized by a recession with inflationary pressures induced by higher inflation expectations. As such, this scenario implies much higher Treasury yields compared to "the severely adverse scenario," and it would be very interesting to see the banks’ losses from negative revaluations of the Treasuries and other bonds on their balance sheets. However, we are yet to see how the Fed will conduct this test, and what assumptions the regulator will use.

The Fed

Counterparty Default Risk: Is It Measured Correctly?

In our previous articles, we discussed in detail that large US banks have tens of trillions of over-the-counter derivatives on their balance sheets and off-balance sheets. We believe these contracts bear the enormous risk for a bank in a volatile environment when there is a very high chance of a counterparty default.

The Fed says that US banks are being tested for counterparty default risk. However, if we take a look at the Fed’s methodology, we will see that this risk is not measured correctly. According to the regulator, "large banks with substantial trading or custodial operations are required to incorporate a counterparty default scenario component into their supervisory severely adverse scenario" and "in connection with the counterparty default scenario component, these banks are required to estimate and report the potential losses and related effects on capital associated with the unexpected default of the counterparty that would generate the largest losses across their derivatives and securities financing transactions, including securities lending or borrowing and repurchase or reverse repurchase agreement activities."

In other words, only losses from the largest counterparty are being incorporated into the stress test, and, even more importantly, these estimates are provided by the banks. Given that over-the-counter derivatives lack any transparency, these estimates of counterparty-related losses are not very reliable in our view.

Maturity Mismatch Is Also Being Ignored

This is another major issue that is not being tested by the Fed. Many US banks have a large maturity mismatch between their assets and liabilities. For example, in our recent article on Capital One, we showed that 84% of the bank’s securities have maturities longer than ten years. Capital One does not disclose the average maturity of its deposit book, which is a major part of its liabilities; however, it's highly likely that it is much less than ten years, especially given that Capital One currently does not offer deposits with a term of more than five years. Such a maturity mismatch between the bank’s assets and liabilities would likely lead to major liquidity issues in a volatile environment and be a significant risk for depositors.

Assumptions for variables describing international economic conditions are too mild

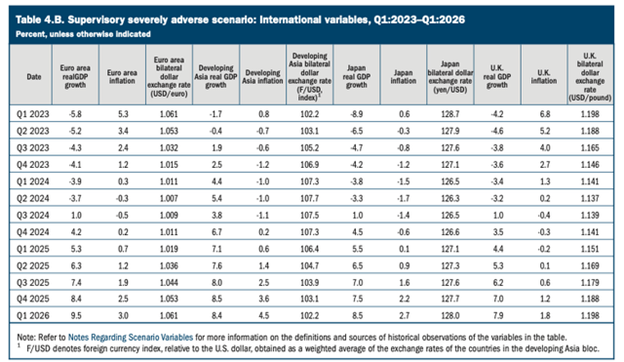

Under its “severely adverse scenario,” the Fed also provides assumptions for variables describing international economic conditions.

The Fed

These assumptions do not reflect that the global economy is in a severe recession, in our view. For example, a decline in the Euro area’s GDP is quite moderate, whereas a recession in Developing Asia appears to be very mild, as the region's GDP fell 1.7% and 0.4% in the first and second quarters of 2013, respectively, before beginning to grow.

US banks have significantly increased their exposure to international economies over the past several years. For example, Bank of America’s non-US commercial credit portfolio grew from $29B as of YE2009 to $128B as of 1H22. 33% of Goldman Sachs’ corporate loans were granted to EMEA's (Europe, Middle East, and Africa) clients.

We believe that such mild assumptions for the international economies do not show the real magnitude of potential losses for the US banks should a severe recession comes.

Bottom Line

There are more red flags and crucial issues that are being overlooked by the Fed, such as the credit quality of the mortgage portfolios and borrowers’ profiles, shares of non-core assets, and off-balance sheet items. By comparison, all the banks we have found at Saferbankingresearch.com were thoroughly tested for these red flags and are quite superior in all respects.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil, and USD, plus a team of analysts covering a range of other markets.