This week was the typical sleepy holiday session, states Steve Reitmeister of Reitmeister Total Return.

Low trading volume and modest price moves which means not much interesting activity worth discussing after the strong June rally to put an exclamation point on the first half of the year.

What matters now is what happens next. And that depends on the Fed rate decisions and what that means for the health of the economy. In particular, if employment remains resilient or if it will finally crack leading to recession and renewal of the bear market.

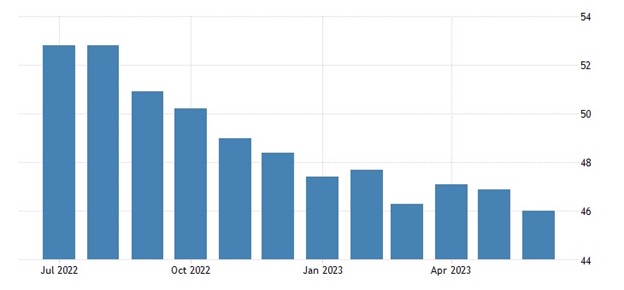

ISM Manufacturing got the July economic data off with a thud on Monday. The overall reading weakened from 46.9 to 46.0. Please remember again that below 50 = contraction. And also remember that manufacturing is considered the leading indicator for what happens to the overall economy. As you can see below the trend keeps cutting lower and lower.

Next consider this quote from Timothy Fiore, Char of the ISM, as to what he is seeing in this month’s manufacturing report:

“Demand remains weak, production is slowing due to lack of work, and suppliers have capacity. There are signs of more employment reduction actions in the near term".

That last part is what demands repeating. That is a sign that employment is finally showing signs of weakening which has been the lynchpin for the recession conversation.

In Q1 and Q2 of 2022, the US economy contracted which is typically the recipe for a recession. However, employment stayed strong and without that pain, then no recession was recorded. This means that we need to see unemployment go up to believe that a recession is afoot and that would reawaken the bear market from its slumber.

This statement from the head of ISM, coinciding with a drop in their employment index from 51.4 to 48.1, could indeed be a sign that employment is ready to tip negative with higher jobless claims, lower job adds, and higher unemployment rate in the months ahead finally signaling recession.

No...just this ISM reading alone is not enough for bears to wave a victory flag. Just an interesting note of caution investors should consider before overly committing to this rally which appears far too ahead of itself given the concerning state of the economy at this time. Plus given history as our guide the economy is likely to only get worse the longer the Fed keeps raising rates to stamp out growth and inflation. (12 of the 15 last rate hike cycles ended in recession).

Speaking of the Fed, the odds of a 25-point rate hike on July 26th is now up to 87% from just 53% just a month ago. This has further inverted the yield curve and thus further increased the odds of a recession forming in the coming year up to 71%.

More economic reports are on the way that investors will want to keep a close eye on including:

7/6 ISM Services: Will it follow ISM Manufacturing into negative territory? Well, last time it dropped from 51.9 to 50.3...barely in expansion territory. Also of interest will be the employment component which tipped negative last month. That combined with weakness in the ISM Mfg employment component could tell us something about the next set of jobs reports.

7/6 ADP Employment & JOLTs: Investors will look for clues in these two employment reports to predict what shows up Friday in the more widely followed...

7/7 Government Employment Situation Report: Investors are still expecting 250,000 jobs adds showing the strength of the jobs market. That seems a bit elevated and perhaps set up for disappointment. Further, investors will keep a close eye on changes in Average Hourly Earnings. This form of sticky wage inflation has been bothering the Fed and keeping them on the rate hike warpath. So this wage component will have a good deal to do with future rake hike decisions.

7/12 CPI & 7/13 PPI: These monthly inflation reports will also have a market-moving impact as they certainly will factor into the next element...

7/26 Fed Rate Hike Decision: To be honest, the pause last month made no sense when you are saying more work to do and likely two more rate increases. At this stage, it is a foregone conclusion that a rate hike will come in late July. Thus, the key to market reaction will be statements by Powell to see if the committee still sees one or more rate hikes and when they might be ready for a pivot to greater accommodation.

I still believe the facts point to recession and the return of the bear market as the most likely outcome. Yes, I understand the price action is clearly saying something else. But that is just the pendulum of fear and greed for you...it always swings too hard in one direction before swinging back to the other.

The key for investing at this time is to maintain a balanced investing posture...like 50% invested in the stock market.

If indeed I am right that Fed is working overtime to create a recession...then when those signs become more evident to investors stocks will tumble and we can get more defensive in our portfolio (selling Risk On stocks + upping the ante on inverse ETFs to profit on the way down).

If the Fed amazingly generates a soft landing, then I will be happy to heed those signals by getting more aggressively long the stock market.

But let’s remember the Fed themselves are predicting a recession will form before they start lowering rates. When you consider the historical optimistic bias of Fed statements, then more investors should appreciate why being bullish now seems a bit premature.