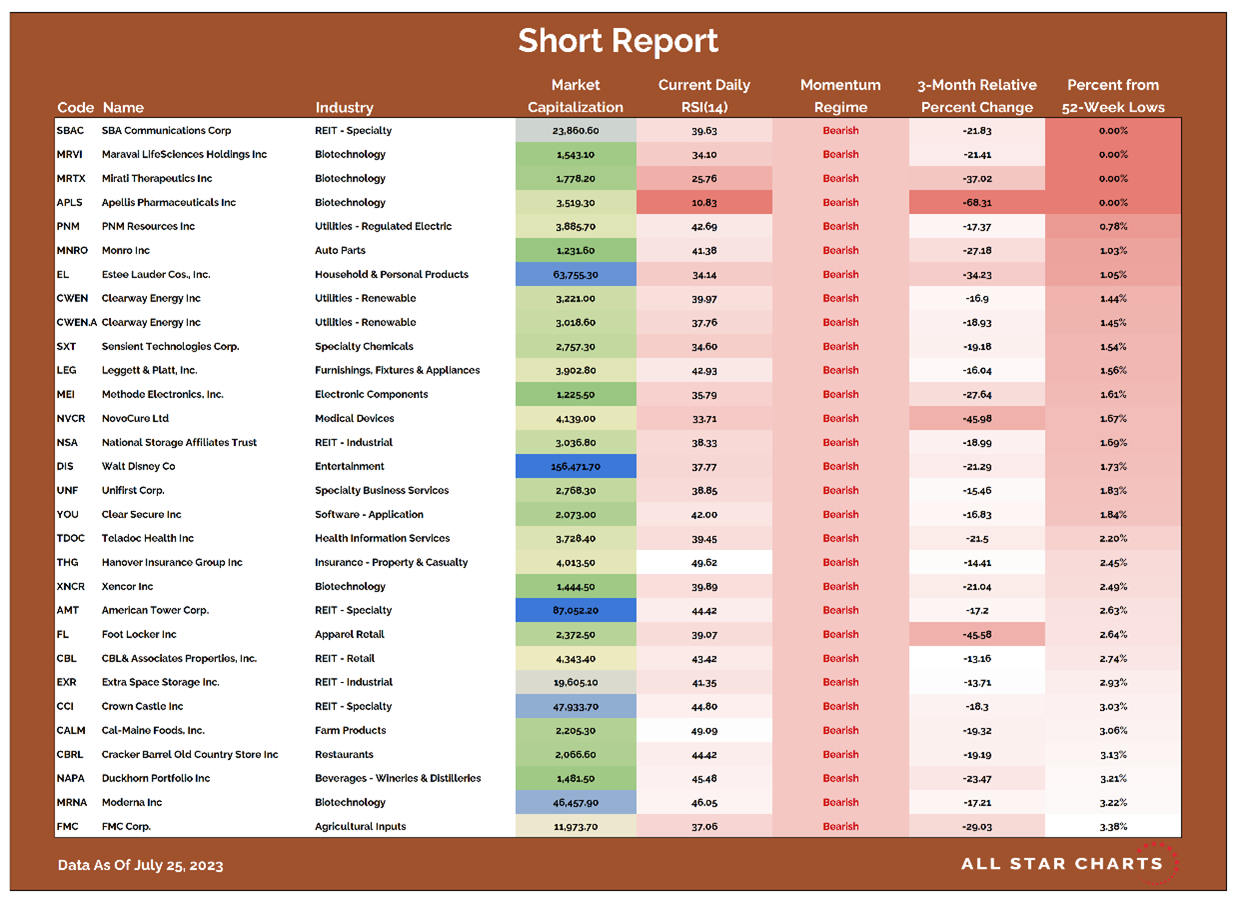

The purpose of this scan is to highlight our favorite short setups in some of the worst-performing stocks in the world, states Steve Strazza of AllStarCharts.com.

We start with every stock in the S&P 1500 with a market cap greater than $1 billion. As usual, we apply price and liquidity filters. And we filter based on relative performance in order to separate the names that are trending lower versus the broader market.

We eliminate any stocks that are in bullish momentum regimes, as overbought readings are characteristics of uptrends—and we’re looking for downtrends. Then, we remove any stocks that are not within 5% of 52-week relative lows. Finally, we sort this list by proximity to new 52-week absolute lows.

Here’s our current list of laggards:

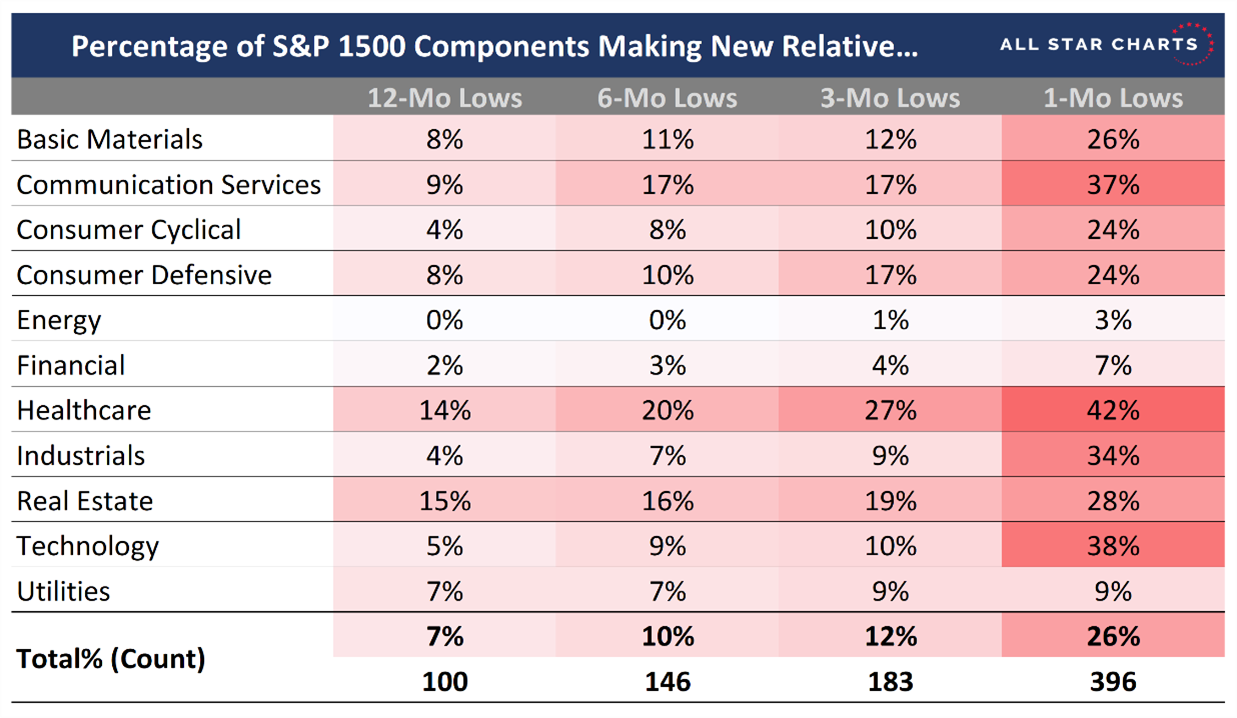

And here’s a look at new relative lows by sector:

This shows us how many stocks in the S&P 1500 have made new relative lows against their benchmark across multiple time frames over the trailing five days. The lack of short-term relative weakness across the Energy and Financials sectors highlights this week’s main takeaway. Rotation is underway, and cyclical sectors are reaping the benefits.

On the flip side, Technology, Healthcare, and Communication Services represent the short-term laggards this week. We expect these sectors to underperform after their massive run this past month.

To learn more about Steve Strazza, please visit AllStarCharts.com.