In, "How to Prepare for Earnings Season: Part 1", I discussed my first steps in prepping to trade earnings season, including making my earnings calendar, identifying optionable tickers to trade, and honing in on volatility, states Danielle Shay of Fivestartrader.com.

Next comes deciding how to sit down and approach the season, which means knowing what options and strategies you want to use. This will depend on your experience level, personality, interest level, and more! ‘Trading earnings’ is a broad topic, as it can be done in many ways! That is one of my favorite aspects of being a trader. There are so many ‘options’ when selecting options strategies! Where should you begin? It all starts with what your overall goal is.

Speculative Bias in the Stock Market

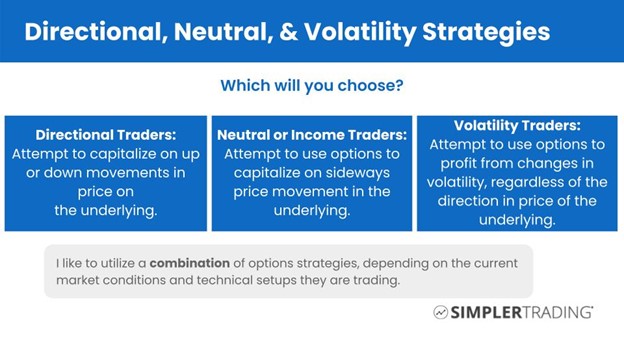

Options are a speculative, leveraged tool in the stock market. So, how do you want to use them? Are you trying to speculate on which direction the market goes, bet on sideways action, or purely bet on the rise and fall in volatility without care for the price direction?

When I first started trading, I began as a directional trader. That’s because the lure of explosive gains initially interested me in options trading! I’d have to bet I’m not alone in this thinking. However, I have focused substantially more on income-based and volatility trading over time. That’s because both tend to be more forgiving, and consistent and don’t require as much management or directional bias. Between managing kids and my media schedule, these are all highly alluring positives related to these trading styles!

So, which is which? Let them break it down.

Directional Trading

Objective: To capture and profit when an underlying makes a directional move from one price to another

Key Characteristics:

- Price Focused: Directional strategies often revolve around the idea that the underlying price will make a big move in the speculated direction.

- Common Strategies: Include calls, puts, debit spreads, and butterflies

- Risk & Reward: Typically have substantial potential rewards if the direction and price targets are identified expertly

Neutral Trading

Objective: To profit from an underlying asset that remains within a specific price range or exhibits minimal price movement over time.

Key Characteristics:

- Price Focused: Neutral strategies often revolve around the idea that the underlying price will not move significantly in any direction.

- Common Strategies: Include iron condors, butterflies, and calendar spreads.

- Risk & Reward: Typically have defined risk and reward, aiming for consistent but often smaller profits.

Volatility Trading

Objective: To profit from changes in volatility, regardless of the direction in which the price of the underlying asset moves.

Key Characteristics:

- Volatility Focused: These strategies are based on predictions of the volatility of an asset, not necessarily its price direction. Volatility can be historical (statistical) or implied (derived from option prices).

- Common Strategies: Straddles, strangles, and Vega-based trades are typical. Both buying and selling options can be used to exploit different volatility conditions.

- Different Market Conditions: Traders might expect a surge in volatility (e.g., before earnings announcements or significant events) or a decrease in volatility (post-event or in stable market conditions).

- Risk & Reward: Can be both undefined or defined, depending on the strategy

These days, I like to focus more on volatility-based trading because it allows me to get in and out of the market quickly and still have time for everything else! It also doesn’t require me to pick or be right in the direction, and instead merely trade volatility trends.

Learn more about Danielle Shay at Fivestartrader.com.