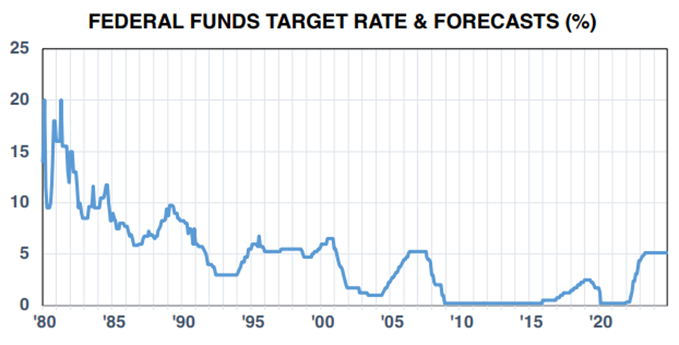

The Federal Reserve wrapped up its latest Open Market Committee meeting last Wednesday and, as expected, raised the federal funds rate by 25 basis points to 5.00%-5.25%. We think this is the last rate hike in the cycle and that the Fed will now move to the sidelines, likely for at least the balance of the year, advises John Eade, president at Argus Research.

This was the tenth increase since the central bank lowered the fed funds rate to the rock-bottom level of 0.00%-0.25% early in the pandemic. All 12 governors were in agreement about the hike, as inflation remains elevated (the latest core CPI reading was 4.9% and the latest core PCE Price Index reading was 4.6%).

So, is this the final rate hike in the cycle? Have rates been lifted high enough to cool the economy and bring inflation down toward 2.0%?

In a press release announcing the hike, the Fed hinted that they might pause. The committee replaced language that said: “some additional policy firming may be appropriate” with the following: “In determining that extent to which additional policy firming may be appropriate.” In the Fed’s view, the banking system remains sound and resilient.

We believe the Fed is finished. As for the economy, we remain concerned that the Fed has tossed its other mandate -- full employment -- out the window in its fight to lower high prices.

The hikes already have brought growth in the housing market to a standstill, and manufacturing has now slumped. Will the consumer sector be next?

The U.S. economy has been walking a fine line between expansion and contraction for the past four quarters. Substantially higher interest rates could tip GDP into recession this year and send the unemployment rate up toward 5.0%. We think the central bank may be lowering rates if the jobless rate rises above the 4.0%-4.5% level by the end of the year.