Will they hike or will they pause? The Federal Reserve will announce a decision on interest rates this week. Meanwhile, the S&P 500 has rallied from the lows of October 2022 and is close to a 20% recovery. Although that would not mark an all-time high, it would bring the market back into bull territory, writes John Eade, president of Argus Research.

Just before that rate call comes an inflation double whammy, with one report related to consumers and another for producers. As well, a few big techs report earnings.

Last week, the Dow Jones Industrial Average was up 0.3%, the S&P 500 also gained 0.3%, and the Nasdaq inched higher by 0.1%. For the year, the Dow is up 2%, the S&P is up 12%, and the Nasdaq is higher by 27%.

Longer-term, the latest hurdle stocks have overcome was the debt-ceiling debate. That event joins a list of market/economic challenges, including the financial fallout from the failure of SVB Financial Group, high inflation, the war in Ukraine, the Federal Reserve’s aggressive rate-hike campaign, mid-term elections, and the ever-present risk of recession.

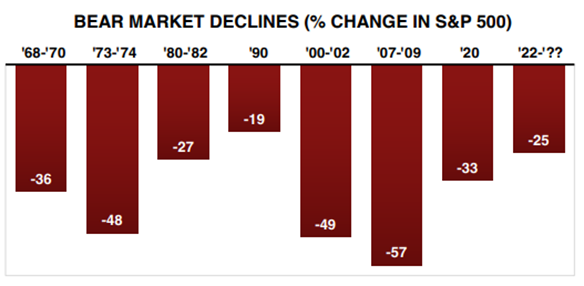

How does this latest bear market compare to the average bear market? The average peak-to-trough decline during the previous seven bear markets was 38%; the lows of this bear market were 25% from the all-time highs.

So, it is a little bit better on performance. But the duration is a bit longer than the normal average, which we estimate is 16 months; this latest 2022-2023 bear market has lasted 17 months.

What’s next? Bear markets are fairly rare, as only eight have occurred in the past 55 years. On average, that’s one bear market every six years. The fundamentals are in place for improvement: interest rates are high and can drop, improving valuations; as well, earnings growth is slow and can ramp up.

A wild card may be the economic environment. Has the Fed gone too far and might the economy be pushed into recession later this year? That’s not what the stock market rally from recent lows is saying.