Shares of Macy's Inc. (M) — one of our top stock picks for 2023 — dipped recently despite Goldman Sachs adding the stock to its "Conviction Buy List," explains Jake Scott, deputy editor Schaeffer's Investment Research.

Goldman Sachs expects the department store giant to make headway on its five pillar growth strategy following successful "trial and learn phases" this year.

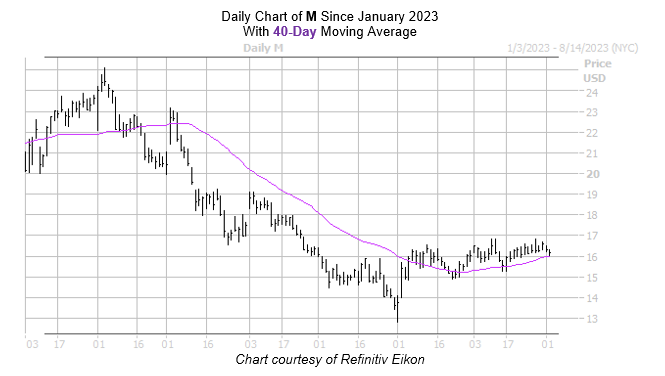

Even better, Macy's stock is a flashing a historically bullish signal on the charts. According to a study from Schaeffer's Senior Quantitative Analyst Rocky White, the shares are within 2% of its 40-day moving average.

The study shows five similar occurrences over the past three years. The stock was higher one month after 40% of these signals, averaging a 5.1% pop. From its current perch, a similar jump would put M just shy of $17 — levels not seen since April.

On the charts, M rebounded nicely from its late-May dip to a more than two-year low of $12.80. The aforementioned $17 level has kept a lid on any further breakouts, however, meaning now could be an intriguing time to enter a new position.

The brokerage bunch is split on Macy's stock, meaning it could benefit from a shift in sentiment. Currently, five analysts rate the equity a "strong buy," while six say the stock is a "hold" or worse.

Meanwhile, the 12-month consensus price target of $17.91 is an 11.5% premium to current levels. Further, the 20.02 million shares sold short account for 7.4% of M's total available float.

Now might be an ideal time to speculate on the stock's next move with options. M sports a Schaeffer's Volatility index (SVI) of 44%, which stands higher than 11% of readings from the past 12 months. In other words, options traders are pricing in relatively low volatility expectations at the moment.