Once again, inflation grabs the headlines this week, while a few earnings reports also trickle in. Investors will continue analyzing comments following the last Fed rate meeting, seemingly focused on the “higher for longer” concept as many wonder exactly what ‘longer’ might mean, writes John Eade, president of Argus Research.

The Dow Jones Industrial Average ended last week down 1.9%, the S&P 500 lost 2.9%, and the Nasdaq shed 3.6%. Year-to-date, the Dow is up 2%, the S&P has gained 12.5%, and the Nasdaq is higher by 26%.

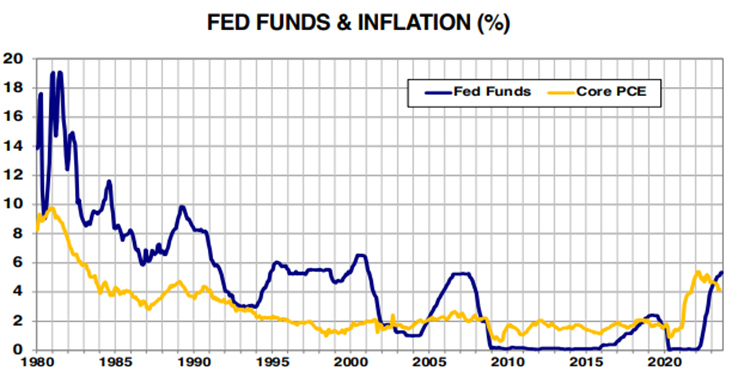

The economic calendar is full of data this week. The big day is Friday, when the Fed’s favorite inflation numbers come out. The Personal Consumption Expenditures Index, or PCE, posted at 3.3% last month and is expected to move higher because of rising energy prices. Argus forecasts PCE will hit 3.4% for August. Core PCE posted at 4.2% in July. Argus’ forecast is 4.0% for August.

Friday also brings new data on Personal Income, Personal Spending, and Consumer Sentiment. Elsewhere, today brings an update on New Homes Sales; Wednesday features Durable Goods Orders; and Thursday brings an update on GDP. Finally, several Fed officials speak publicly this week, including Chairman Powell on Thursday at a Town Hall with educators.

Last week, and as expected, the Fed left interest rates unchanged but made it clear that rates will be higher for longer than many had forecast. They also said that lowering inflation -- and not necessarily achieving a so-called soft landing -- is the primary goal. The Fed’s “dot plot” forecasting tool indicates one more rate hike is likely this year.

On the earnings calendar this week, Wednesday, Micron Technology, Paychex, and Jefferies weigh in. On Thursday, BlackBerry, CarMax, Jabil, Vail Resorts, and Nike. On Friday, Carnival steps up. The big banks will kick off the next big round of results in mid-October, with Citigroup and JP Morgan releasing results on October 13.

Mortgage rates stayed flat but remain well over the 7% threshold, at 7.18% for the average 30-year fixed-rate mortgage. Gas prices went up six cents to $3.88 per gallon for the average price of regular gas. The Atlanta Fed GDPNow indicator for 3Q currently forecasts expansion of 4.9%. The Cleveland Fed Inflation Now forecast for September is 3.69%.