The top-level inflation rate in the US fell to the lowest level since September 2021 on a year-over-year basis last month, as most price increases appear to be easing. The rate of core inflation also continued to tick lower. We look for the US central bank to be lowering rates in 2H24 as their concern shifts toward economic growth, shares John Eade, president of Argus Research.

The Bureau of Labor Statistics reported a 3.1% increase in overall inflation year-over-year through November, compared to a 3.2% rate through October and a 9.1% rate back in June 2022. The core rate, excluding the impact of food and energy, was steady versus the prior month at 4.0%. Month-over-month, the all-items CPI ticked higher by 10 basis points, and the core CPI increased 30 basis points.

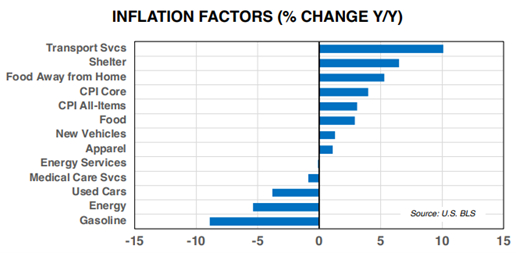

Segments of the economy with stable/easing prices year-over-year included Energy (-5.4%), Used Cars & Trucks (-3.8%), and Medical Care Services (-0.9%). New Vehicles and Apparel prices increased at annual rates of 1.3% and 1.1%, respectively. Inflation rates continue to be propped up by Transportation Services (10.1% yoy) and Shelter (6.5%).

These categories tend to have stickier prices. We continue to think the June 2022 CPI rate was the peak reading for the index this cycle, as the housing market cools off, supplies of new vehicles are replenished, and the price of oil stays below $90 per barrel.

The Fed has lifted the federal funds rate from 0.0% to above 5.25% over the past 18 months, and the rate hikes appear to be reducing inflationary pressures. The next question is whether the rapid rate of increases will tip the economy into a recession as inflation continues to head toward 2%.