Earnings continue to flood in this week, but there are no major economic reports. Wall Street will continue to break down that surprisingly strong jobs report from Friday and football fans will gear up for the Super Bowl on Sunday, explains John Eade, president of Argus Research.

Last week, the Dow Jones Industrial Average ended the week higher by 1.4%, the S&P 500 gained 1.4%, and the Nasdaq bumped up by 1.1%. For the year, the DJIA is higher by 2.5%, the S&P is up 4%, and the Nasdaq is also up 4%.

On the earnings calendar, today brings updates from Chipotle, Ford, Eli Lilly, Amgen, DuPont, and BP. On Wednesday, Disney, CVS Health, Fox, Hilton, and News Corp. On Thursday, Expedia, Philip Morris, and ConocoPhillips. And on Friday, PepsiCo weighs in.

As of last Friday, 46% of S&P 500 companies have reported for 4Q23. Earnings are coming in 7.8% higher than in the same quarter last year. Communication Services, up 52%, and Utilities, up 49%, are performing the best. Energy, down 22%, and Materials, down 20%, are performing the worst.

On the economic calendar, it’s a light week. On Wednesday, the US trade deficit will be reported and Federal Reserve members are on the speaking circuit all week (with at least nine Fed officials having public speeches scheduled).

Last week, the January jobs report stunned Wall Street, showing a surprisingly strong labor market. Nonfarm payrolls shot up to 353,000 versus estimates for about half that number. The unemployment rate matched the previous month at 3.7%.

Mortgage rates dropped a hair to 6.63% for the average 30-year fixed-rate loan. Gas prices inched up three cents to $3.09 per gallon for the average price of regular gas. The Atlanta Fed GDPNow indicator is forecasting for Q4 and calls for expansion of 4.2%, higher than last week. The Cleveland Fed CPINow indicator is forecasting 2.96% for January and 2.95% for February.

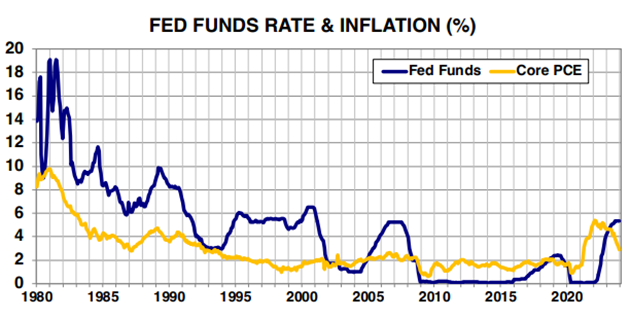

The Fed’s next rate decisions are in March and May. For March, odds of a rate cut are at about 38%, according to the CME FedWatch Tool. That’s lower than last week and follows the big jobs number. For May, odds go up to 94%. That’s higher than last week. At Argus, we don’t call for a rate cut until the second half.