We have seen confidence increase across several different economic areas. For example, we recently saw a move higher in small business optimism, homebuilders’ confidence, and consumer confidence. Invesco S&P SmallCap Momentum ETF (XSMO) is a name I like here, says Brian Kelly, editor of Money Letter.

Sentiment was also buoyed by a blowout labor report recently. The trend for US stocks continues to be higher. And our review of various contributing conditions shows more checkmarks supporting stocks than detracting...

1. We’re near the end of higher interest rates. We may only get three Fed rate cuts in 2024 instead of the six that the markets have been pricing in (and the markets will react with volatility until expectations meet reality). But the Fed pivot is the key. There are no more hikes on the horizon, and it appears we will get our first cut sometime in late spring. Historical data shows significant gains in the S&P 500 in the year following the first Fed cut.

2. Chances of an economic soft landing continue to be good. How do we know? There is plenty of evidence that the consumer is strong and resilient. The jobs report for January and the recent job openings report confirm a tight labor market and plenty of jobs to fill.

Inflation is also receding. This data indicates it will be very hard for the economy to fall into recession, taking one of the fundamental risks to stocks practically off the table.

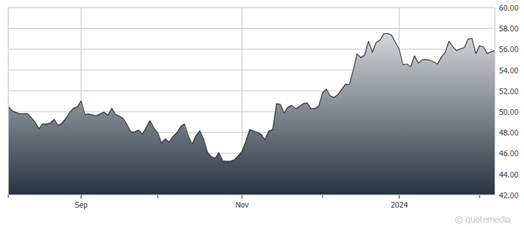

Invesco S&P SmallCap Momentum ETF (XSMO)

3. Geopolitics have not had a major effect on global inflation so far. We consider this to be the biggest near-term risk for stocks as we sit today. With the US retaliating against Iranian proxies and the ongoing war between Israel and Hamas, the risk of widespread hostilities in the Middle East is not insignificant. Rumors of a renewed Russian offensive in Ukraine add to the uncertainty.

4. Corporate earnings are expected to grow 8%-10% in 2024. Although there has been a slight deterioration in the earnings picture, there is no negative shock within view.

5. Yields for money market funds and safe bank products will dwindle as the Fed cuts rates, shifting money out of these instruments and toward risk assets.

In this environment, XSMO looks attractive. It seeks to track the investment results before fees and expenses of the Russell 2000 Pure Growth Index. Strictly in accordance with its guidelines and mandated procedures, the index provider compiles, maintains, and calculates the underlying index, which is composed of constituents of the S&P SmallCap 600 that have the highest momentum score.

Recommended Action: Buy XSMO.