We have three strategic asset-allocation models, based on risk tolerance: Conservative, Moderate, and Aggressive. We make tactical adjustments to the models based on our outlooks for the capital markets. Right now, our Stock-Bond Barometer model slightly favors bonds over stocks for long-term portfolios in light of the recent rally in equities, explains John Eade, president of Argus Research.

February was a solid month for equity investors, as the S&P 500 advanced 5.3%, compared to a 1.8% decline for the fixed-income benchmark ETF AGG.

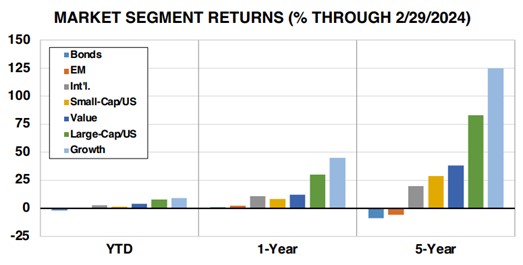

Drilling down into stocks, we are overweight on large-caps. We favor large-caps for growth exposure and financial strength, while small-caps are selling at historical discounts relative to large-caps and offer value.

Internationally, US stocks have outperformed global stocks over the trailing one- and five-year periods. We expect this to continue, given the US market’s embrace of the innovative Tech sector. In terms of growth versus value, we anticipate that, over the long term, growth, led by the Tech, Consumer, and Healthcare sectors, will top returns from value, led by Energy, Real Estate, and Materials, due to secular and demographic trends.

As for the fixed-income segment of a portfolio, we break bonds into four areas: Core, such as the industry benchmark ETF AGG or Treasuries; Inflation-Indexed; Opportunistic, such as securitized debt, corporate debt, high-yield or floating bonds; and Cash.

We are focused on Core and Opportunistic. On duration, we recommend a shorter term. Last are alternatives. Given the early stage of the current bull market, we think alternatives are less desirable in the growth portion of our models.