Sponsored Content - The recent troubles of the huge property developer turned quasi-hedge fund Evergrande have raised questions anew over whether China is in for a major BUST, says Chris Temple, editor and publisher, National Investor Publishing.

There seem to be two general extremes as to the views of this:

- The “nothing to see here” one says that China will be able to paper over this problem just like so many others, on its way to being THE King of the Hill globally.

- The “Doomsday” crowd insists, THIS IS IT! China finally bit off more than it could chew and will soon end up like the last “yellow peril” that was poised to take over the world—Japan—a few decades ago. Japan’s run to be King of the Hill (in global markets, anyway) ended when its bubbles started bursting in 1989. Today, Japan is all but irrelevant globally.

In my commentary on Evergrande (primarily) from about a week ago, I argued that the likely outcome(s) won’t be defined in those terms or by either of those black-and-white possible scenarios (though the risk of a bust IS ever-present, even if such is not the base case.)

Instead, that “marketized default” of Evergrande is going to serve as a catalyst for the biggest changes to the established global order of things than anything we have seen in many years. The move away from the inter-woven global supply chains for everything…the finance and investment—likewise global in nature—that lubricated all that…the general cooperation and consolidation of most everything under global umbrellas that provided the frameworks and oversight of the post-World War II environment…is going to ACCELERATE.

And with that will come major upheavals along the way in global financial and commodity markets that are not remotely prepared for the changes that are NOW UNDERWAY!

Digging far deeper into all of this following my above-linked article, I caught up this past week with my old friend, long-time Washington area journalist Cliff Kincaid. Among other things a regular years ago on CNN’s Crossfire, Cliff these days is president of America’s Survival.

Cliff (who likewise looks at things FAR differently than is either common practice or allowable in today’s scripted “left” vs. “right” media world) and I REALLY break the mold in our discussion of China’s change of course/agenda and a whole lot more.

Keep in the back of your mind the fact that recent years have already seen a fraying of the globalization regimen that has governed the last several decades. And even if the “West,” led by America, is still generally inclined to cling to this world order (for the most part RUN by the US in the post-war era of course) China is NOT if it is no longer in that country’s best interests.

And it isn’t.

Of the MANY topics we cover both in depth as well as in our mold-breaking way, we discussed the following:

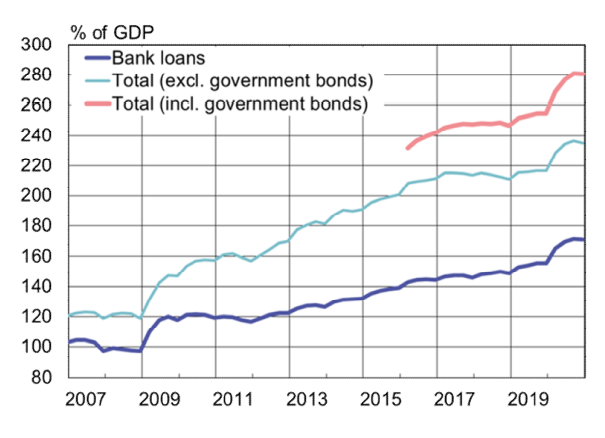

- China is in considerably greater financial/monetary peril than is the US (among other things, China’s debt-to-GDP ratio is more than double that of the U.S.) By the end of 2020, China’s total acknowledged public and private debt exceeded 300% of GDP; and that likely does not include debt in the country’s shadow banking system.

- Exactly HOW China got into this mess, by going farther as a country (and allowing entities like Evergrande to do the same) in graft, greed, abuse of debt, and oftentimes, IDIOCY than anything ever done by either the extinct Enron…or the Federal Reserve.

- More on President Xi Jinping’s decision to have China revert “back” to a more traditional communist state in order to consolidate/keep power.

- Implications of all this for globalization generally…as well as for China’s role as IT sees things evolving in a multi-polar world.

- How and why all this means that the notion that China’s currency can still rival the US dollar as a global reserve is now done for (though DON’T expect to see an end to the many come-ons telling you that a new Chinese “petro-yuan”…gold-backed renminbi…or whatever is about to “replace the dollar.”)

- The KEY reason for China’s recent crackdown on Bitcoin and other crypto currencies.

- How both President Xi and US President Joe Biden have recently set the table a bit more for military conflict (which, among other things, will provide a convenient diversion for both leaders from looming/renewed economic and market problems.)

- Eerie—and DANGEROUS—similarities in the US Deep State (which, lest you think otherwise, gives “China Joe” his marching orders) in its attitude toward China today with that of its approach to the now-extinct USSR once upon a time.

- Why it should not seem so strange to anyone that China—now that it has gamed the “West” for nearly 50 years, acquiring renewed stature in the world in so many ways—now, under “Emperor” Xi, will be “looking out for Number One” a LOT more.

- The risks that China STILL faces even with its belated attempt to rein in its myriad financial problems and remain relevant—and a rising power—at least somewhat. One that Cliff and I only briefly touched on is that China’s vaunted new “Belt and Road” initiative is likewise starting to crumble as is Evergrande and a LOT more. As Reuters reported just this week the pushback against China trying to conquer countries and resources with DEBT is growing.

- That alone—and the other changes now underway within China—are going to throw a cold, wet blanket on notions of an ongoing, broad new commodity “super cycle.” There are STILL great stories out there; as well as other factors outside of China that are going to lead to new/added investment opportunities. But commodities generally may be soon taking a step or two backward, before taking new ones forward.

In summation where China is concerned—and as I say along the way in our discussion: “We’re at a much more important inflection point for the markets and the global economy than the average person understands. There are implications (in China’s withdrawal from the global order as it has existed for about half a century) for global growth, for commodity prices…for a lot of stuff.”

I’ll be picking up on a lot of this anew in the coming days in The National Investor, as well as providing my own evolving guidance as to how we need to manage our portfolios in light of all this.

If you are not already a Member, visit Chris Temple at NationalInvestor.com.