Sponsored Content - Has the vaunted bull market for commodities already been killed off in its relative infancy, asks Chris Temple, editor and publisher, National Investor Publishing.

It isn’t just the broad stock market that many investors—retail investors in particular—are selling and going away from as we got deeper into the month of May. Many commodities (and the average equity reflecting them) are likewise, with precious few exceptions, stalling out as well. In both cases it’s more of a dwindling interest in doing much of anything that is causing prices to weaken: “buyer’s strikes” of varying degrees sometimes more than outright net selling.

I can understand the overall hesitance on investors’ parts where pretty much all risk assets—even fundamentally sound commodities—are concerned; but to a point. Especially with the recent bank failures and concerns that more are on the table—as well as other financial issues in areas like subprime auto loans, commercial property debt, and the rest—worries about a deflation and economic decline that could get out of hand are not totally without foundation. (That is not my own base case, however, as many of you already know: I continue to call for a longer-term stagflation scenario where—to the extent we do get “another 2008,” which I tend to agree with—that unwinding and deleveraging is going to go on for many years as opposed to weeks or a few months.)

So I am one who believes that, notwithstanding the recent dour sentiment, the superior fundamental profiles for many commodities will ultimately be recognized and re-embraced by investors. And that will be true even if we do slide into recession; indeed, such an event would paradoxically make a lot of these commodity trades look even better when all is said and done. This was but one of numerous causes for longer-term bullishness that The Prospector News’ Michael Fox and I discussed recently.

Given my view that the broad stock market will be eroding anew in the near-medium term, it’s more likely than not that most commodities will be going along for the ride. This will prolong, though, a generational buying opportunity for many critical raw materials and the best companies that explore for/produce them.

In the recent past I have authored two BIG special issues of The National Investor* that go into considerable detail (and include profiles of a number of my recommended companies) on various commodities. If you have not read them, you should. If you have, read them again.

For present purposes, I want to underscore the disconnect between the markets and a number of key commodities that persists:

Gold – Its added character as a monetary asset has allowed the gold price itself to outperform most all other metals in the recent past. The yellow metal has managed to stay above the $2,000/ounce mark as this is written, even if there has been a “force field” of sorts at the all-time high near $2,070/ounce.

Yet at the same time gold (for the third time in three years, as you see) maintains this level, gold stocks remain mired in an on-again, off-again down trend since their highs way back in 2011. There are numerous reasons for this, as I explain in This is NOT Your Father’s Gold Market!* And I have been correctly warning even with this strength of late in the gold price itself that all the pieces aren’t quite in place yet for a break to the upside for gold stocks especially (which, as you see via the chart below of the ETF GDXJ, have surrendered a third or so of their value the last few years even with gold even.)

Yet as I just discussed with “The Mercenary Geologist” Mickey Fulp on our weekly Kitco podcast, gold’s time may be nearing. And in any event, to me it is but a matter of time before we get the kind of breakout to new all-time highs for gold that will finally start to drag precious metals equities along in a broad way.

Uranium – Of all the non-monetary critical materials (this space will be the subject of my next special issue coming out very shortly) this fuel for nuclear reactors and more is a commodity I have been the most bullish on for the last couple years or so. For the many reasons I’ve discussed along the way (and will recap/expand on in this coming newsletter) the renaissance pretty much everywhere (save for insanely suicidal Germany) for nuclear power as perhaps THE best means to reduce carbon emissions is well underway. As a result, the uranium price in the spot market has ratcheted higher for a while now, from lows well below $20/pound to well above $50/pound these days.

Even here—and notwithstanding a very strong run these kinds of stocks had in the last half of 2021 and into 2022—the far better fortunes for this space these days has not always been reflected in valuations. It certainly is not now. Though it has closed this gap a bit in recent trading days, even the Sprott Physical Uranium Trust has regularly seen its market price 10% or so below its net asset value: that is, below the cash value of the physical uranium it owns! And similarly to the fate of gold-oriented equities, those reflecting uranium have eroded a fair bit after that prior strong run, as you see below.

Copper – Perhaps the most astonishing present disconnect concerns copper, the key metal for infrastructure, electrification and the purported future of electric vehicles (EVs.) Global stockpiles are extremely stressed, with knowledgeable people in/covering this industry warning that major supply shortages may well manifest themselves before 2023 is over. I covered this in some detail recently in my New FAANGs special report.*

Here and here, you can also read a couple more sobering pieces on the copper market. These should motivate thinking investors NOT presently asleep to be placing their bets on a multi-year bullish copper market still ahead.

Yet even here—as with most other commodities—the “pros” have engaged in knee-jerk selling on almost every data point suggesting a slowing economy. And retail investors remain asleep as well. Despite the structural supply issues, the red metal is down some 15% in 2023 (though off last summer’s lows) and by 25% from its early 2022 high.

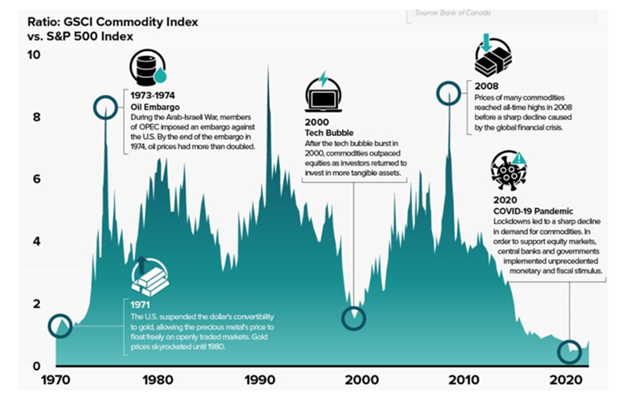

In my recent New FAANGs issue, I discussed the various secular changes in the commodities complex set to turn the above chart upside down in the coming years. Few understand these dynamics, not the least of which is that the many sources on the planet for uber-cheap metals, etc. are drying up, as the real owners of those resources demand a fairer deal for (largely) developed world’s needs. And this dynamic is not isolated only to developing nations: in Canada, a massive legal move is underway which, in the end, could substantially raise the prices of commodities from that key country: see here.

I’ve mentioned but a few examples: in my New FAANGs issue, I also discussed the disconnect between reality and part-confused, part-sleeping markets where crude oil, lithium and others are concerned as well. But some are NOT confused: key industry players who are scrambling to tie up what they understand to be attractive assets while they can.

As this is written, Australia’s Newcrest has just finally agreed to be bought by Newmont Mining in the biggest-ever merger in the gold space. Energy infrastructure giant ONEOK has just bought Magellan Midstream Partners. Glencore is still angling for Teck Resources’ base metals unit (and is not the only one.) And Australia’s Allkem has just agreed to buy lithium giant Livent in its bet on “a green arms race” evolving. These are but a few of the biggest deals/sought deals among many others that have been taking place.

All told, I remain firmly of the opinion that we already have started a trend, which will broaden out in the years ahead: one which will see a sustained and wider outperformance of commodities (and equities related to them) as opposed to conventional financial assets. Make sure to take advantage of the resources below, as well as more that we’ll be posting to our web site in the near term.

*For MUCH more on all these themes—as well as profiles on a number of Chris’ recommendations in these areas—email Chris at chris@nationalinvestor.com for a FREE copy of his recent blockbuster report on The New FAANGs, as well as This is NOT Your Father’s Gold Market!