In this week’s Macro Theme, we review our “Slowing Dragon” theme. We began discussing publicly in November 2017. Chinese equities have since entered and remain solidly in crash mode, writes Landon Whaley Wednesday. He's presenting at MoneyShow Dallas.

Meanwhile the Gravitational developments since our last update August 1 indicate further downside ahead.

Slowing Dragon continues to present us with opportunities to bet against the equity market over there via the iShares China Large Cap ETF (FXI).

Fundamental Gravity says what?

Two chief variables impact the risk and return of asset prices: economic conditions and how central banks respond to those conditions. Together, these variables drive what we call an economy’s Fundamental Gravity.

Despite the deserved criticism of the accuracy of Chinese data, it’s better to be data-dependent than nothing at all. To that end, we pay particular attention to what we refer to as The Big 3: industrial production, retail sales and fixed asset investment. Based on last week’s reporting of August data, the Big 3 are signaling more of the same for the slowing Chinese economy.

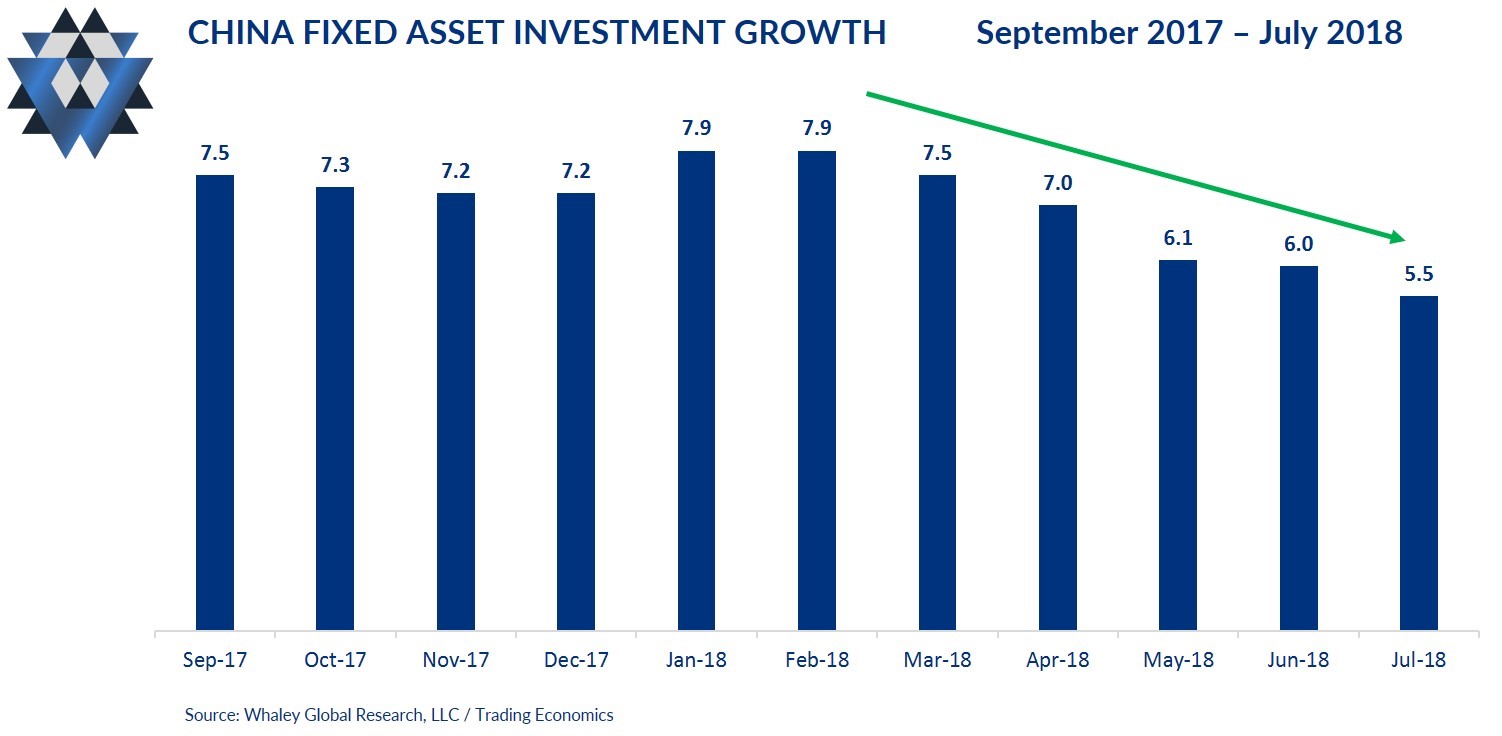

Industrial production has slowed in three of the last six months, and despite a +0.1% improvement in August, it still sits at multi-year lows. Retail sales have been in a bear market since 2010 and hit yet another lower intermediate-term high of +10.3% last September. Since that peak, sales growth has re-engaged its downtrend, and is now sitting at +9.1%, just off all-time lows. And finally, an historical primary driver of the Chinese economy, Fixed Asset Investment growth, has now slowed for six consecutive months and is sitting at a paltry +5.3%.

But it’s not just three data sets flagging further Fundamental Gravity #3/4 environment in China.

The Caixin Manufacturing PMI has slowed for three consecutive months (four of the last seven) and is sitting at the lowest level since 2016. The government’s own measure of manufacturing production has slowed in three of the last five months and is well below the peak rate of +8.1% from last September.

Caixin Services PMI has slowed for two consecutive months, is off the multi-year peak seen in January and sitting at the same level as a year ago. The government’s measure of non-manufacturing PMI continues to make a series of lower highs and is sitting at 54.2, well off the multi-year peak of 55.4 seen last September.

The growth side of the equation hasn’t changed direction all year; it’s simply continued to deteriorate. Now let’s turn our attention to the inflation side of the economic equation.

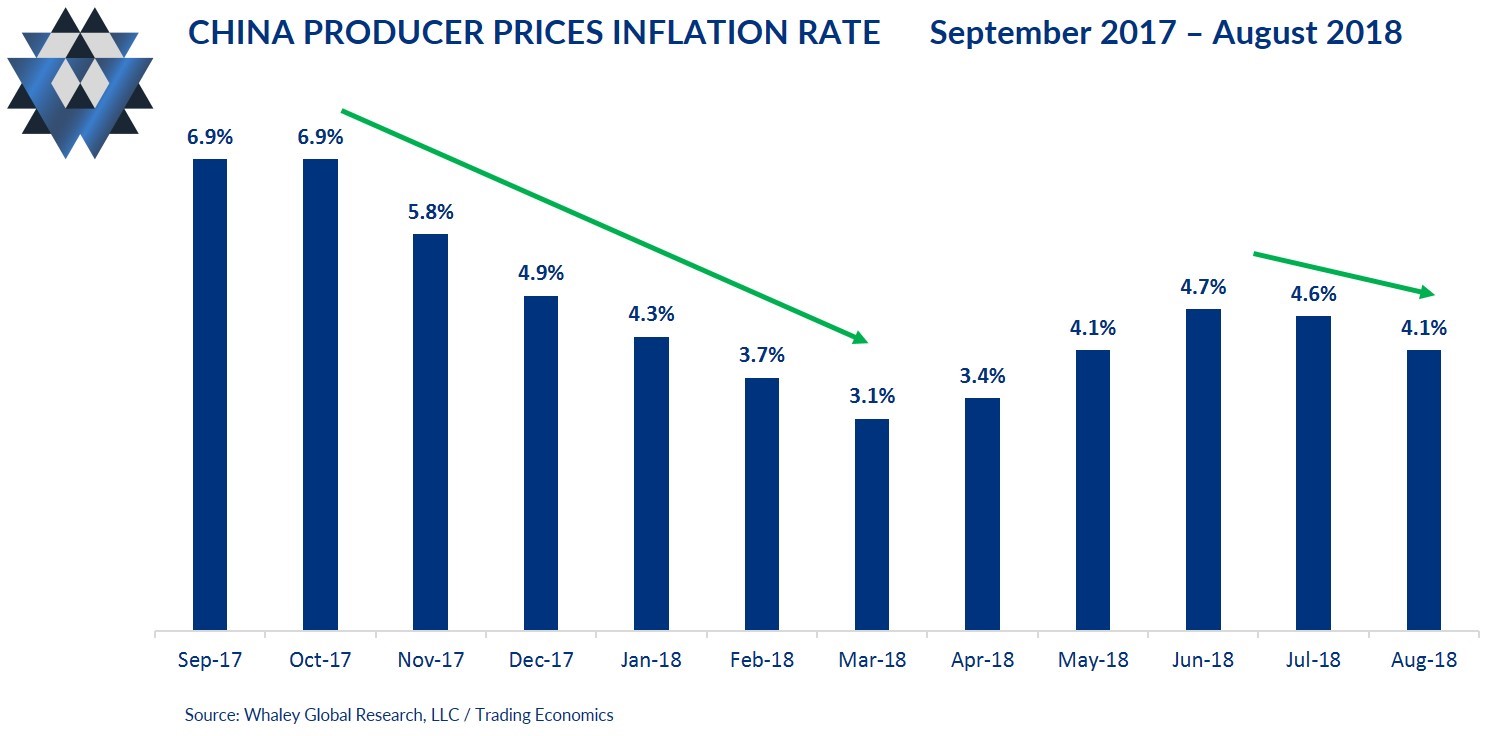

Producer prices have slowed for two consecutive months and remain in a bearish trend since peaking at +6.9% last September. Core inflation accelerated in August for the first time in eight months, by a whole +0.1%, up to +2.0%. This minute acceleration is even less impressive when you consider that core inflation ran above +2.0% for all of 2017 before peaking at 2.5% back in February. And finally, China’s CPI has managed to accelerate for three months, after a consistent downtrend since Q4 2017. That said, CPI is nowhere near the February peak of +2.9%.

Bottom line is that the most likely trend for growth is lower from here, and despite a two-month bump in inflation, that downtrend remains intact as well.

From a Fundamental Gravity perspective, it doesn’t get more bearish for Chinese equities than when the economy is oscillating between Fundamental Gravity #3/4 environments. During this type of Fundamental Gravity environment, FXI typically averages a -4.4% quarterly return, with an average quarterly drawdown of -16.5%. In addition, it posts negative three-month returns 67% of the time.

The Fundamental Gravity bottom line is that a wide swath of Chinese data continues to flag slowing growth as we enter Q4 2018. Despite a mild move to higher inflation throughout the summer, the inflationary downtrend remains very much intact and likely heading lower.

Slowing Dragon and shorting FXI. Part 2

This Friday, September 21, we will release part 2 of this commentary, which is where we will dig in to the other two critical forces, or gravities, that are currently impacting Chinese equities: Quantitative and Behavioral. We will also provide a detailed game plan for trading FXI.

If you can’t wait the 48 hours to get the complete picture for this macro theme and the accompanying trade details, please email us at ClientServices@WhaleyGlobalResearch.com with the subject line “Slowing Dragon.”

We will provide you with the complete macro theme breakdown as well as sign you up to participate in an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.

Mike Larson's Trading Lesson: Will China play "Trump Card" in trade war? Watch bonds.