Here is a unique trade to exit a long stock position using deep in-the-money options, notes Alan Ellman.

Covered call writing is used predominantly to generate cash flow in a low-risk manner. But it can also be used to exit stock positions while mitigating losses in those trades. Selling deep In-the-money calls to exit stock positions, can be profitable, but traders should use caution. As an example, I will use a series of trades shared with me by one of my subscribers (will call her Ashvin) on May 16, 2019. The underlying security was the iShares MSCI Brazil Capped ETF (EWZ).

Ashvin’s trades

- Jan. 17, 2019: Buy EWZ at $43.09

- Jan. 17, 2019 – Apr. 22, 2019: Write monthly out-of-the-money calls to generate cash flow

- May 16, 2019: EWZ trading at $38.24 with the May 17, 2019 short call deep out-of-the-money

- May 16, 2019: Looking for a plan to exit the under-performing EWZ and mitigate share loss

Ashvin’s proposed plan

Selling the June 21, 2019 deep in-the-money $22.50 strike would generate a bid premium of $19.60. Assuming the option is exercised at expiration, the loss would shrink to 99¢ per-share. This would not even include the premiums generated to date. Here’s the math:

$43.09 (original purchase price) – [$19.60 (call premium) – $22.50 (shares sold at the strike)] = 99¢

Breaking down the math with The Ellman Calculator

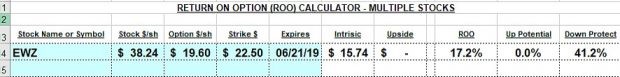

EWZ Calculations with the Multiple Tab of The Ellman Calculator

The spreadsheet highlights some critical points we must be aware of when making our investment decisions:

- There is a huge time-value return on our option of 17.2% which results in significant mitigation of share loss

- There is also huge downside protection of 41.2% of that time-value profit

Digging deeper into these numbers

The option premium (time value + intrinsic value) tells us that the market is anticipating substantial volatility in EWZ and doesn’t specify direction. All the benefit and good news reflected in the spreadsheet must be tempered by the understanding of the risk to the downside for this high implied volatility security. If this trade is executed, it must be carefully monitored and perhaps closed should we see that downside protection eroding rapidly.

Discussion

Selling deep in-the-money calls is a viable way to close a long stock position and mitigate losses when there is a time-value component to the premium. Options that offer significant time value returns with substantial downside protection have high implied volatility and so we must be prepared with our exit strategy arsenal, if needed.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. FREE Beginner’s Corner Tutorial for Covered Call Writing has Been Enhanced and Updated here:

Elite version of the Ellman Calculator