What the crude oil market collapse is telling us about the broad economy, notes Mike Larson.

This is the week the crude oil market imploded. And no, that isn’t hyperbole.

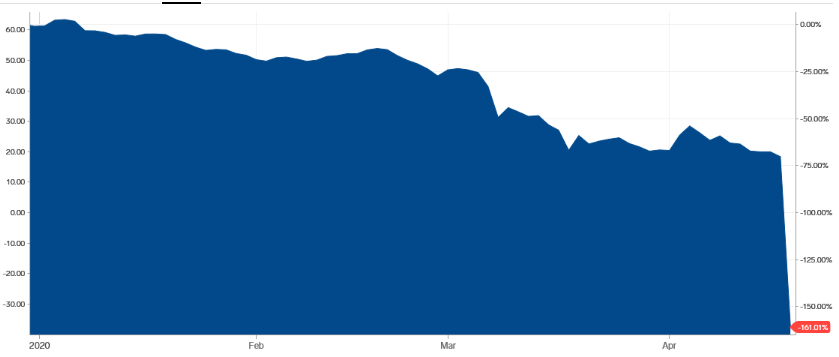

The price per barrel of the front month West Texas Intermediate (WTI) benchmark U.S. crude oil futures contract started trading in the high-teens early Monday. But before long, selling began to intensify and the bottom began to drop out. By the end of the day, oil had plunged to negative, yes, NEGATIVE ... $35 per barrel!

Source: Business Insider

That has never, EVER happened in the history of the oil futures market, which has been around since 1982. A negative price means that producers are so awash in crude — and seeing so little demand for their product — they’re essentially paying buyers to take oil off their hands.

The usual bullish crowd tried to make excuses for the move. They said it was just an anomaly tied to the monthly rollover in futures. After all, the May contract was going off the board soon and the June contract was becoming the more actively traded.

But even June crude tanked by a double-digit margin. Then, on Tuesday, THAT contract plunged even further — losing more than 50% at one point. Brent crude, the international oil price benchmark, also began to collapse.

In other words, there is just too much oil floating around out there and nowhere to put it. Producers are responding by cutting back production, but it hasn’t been enough to overcome the steep drop in demand.

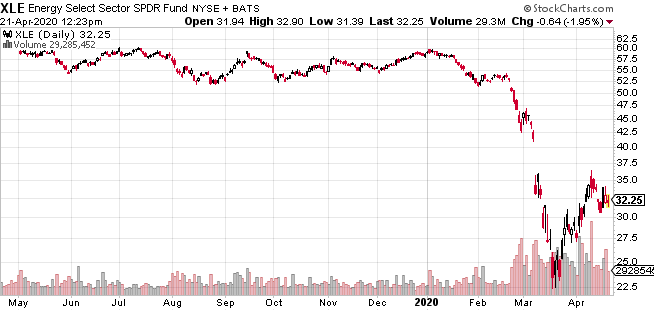

Obviously, this is a huge problem if you’re long in the oil market or derivatives like energy stocks. The Energy Select Sector SPDR Fund (XLE) has been an unmitigated disaster, down 44% year-to-date.

But what’s even more important from a broad market perspective is the message this implosion sends about the economy post-outbreak.

The stock market and the high-risk, high-yield (junk) bond market both rallied sharply off the March lows. But this surge only came from Federal Reserve efforts to backstop wide swaths of the capital markets, rather than real improvement in the underlying fundamentals.

Chasing Fed-fueled rallies worked very well during the record-long economic expansion and corresponding bull market. But now we’re in a bear market, and that cavalier approach is now fraught with danger.

This is because the real economy keeps slumping, despite the Fed’s efforts to levitate the asset markets. The Wall Street Journal chronicled the wild disconnect in a recent piece titled “The Stock Market Is Ignoring the Economy.”

Bottom line? The Fed can buy all kinds of assets if it wants. But it doesn’t change the fact the real economy is in a world of hurt.

It doesn’t change the fact the underlying fundamentals in higher-risk credit markets stink.

And it doesn’t change the fact that the Fed has failed to inflate assets in previous times when underlying conditions were dismal. Indeed, despite the Fed’s massive rate cuts, bank bailouts and extreme QE during the Dot-Com Bust and Great Financial Crisis, the markets didn’t stop deflating until assets got cheap again and buyers were willing to bargain hunt aggressively.

So, while some investors will follow the Fed, you shouldn’t. Instead, stick with my “Safe Money” approach — the same one that has been outperforming the markets since Q1 2018.