I expect stocks to have a good year, but 16.7% in returns is probably unlikely. It’s also worth noting when earnings are growing, corrections only last a couple months until new highs are made, says Don Kaufman, co-founder of TheoTrade.

The headline risk the market faces needs to be contextualized in terms of if it will affect earnings. It’s a difficult and emotional process to determine if headlines affect the market because at the moment headlines can seem very important.

However, recognize that the media needs to sell stories to get clicks. By making the odds of a trade war seem higher than they are, the stories get more attention. Furthermore, it’s possible that President Trump is trying to make the tariffs seem bigger than they are to get a geopolitical reaction.

Recognizing these factors helps you understand why a trade was is unlikely.

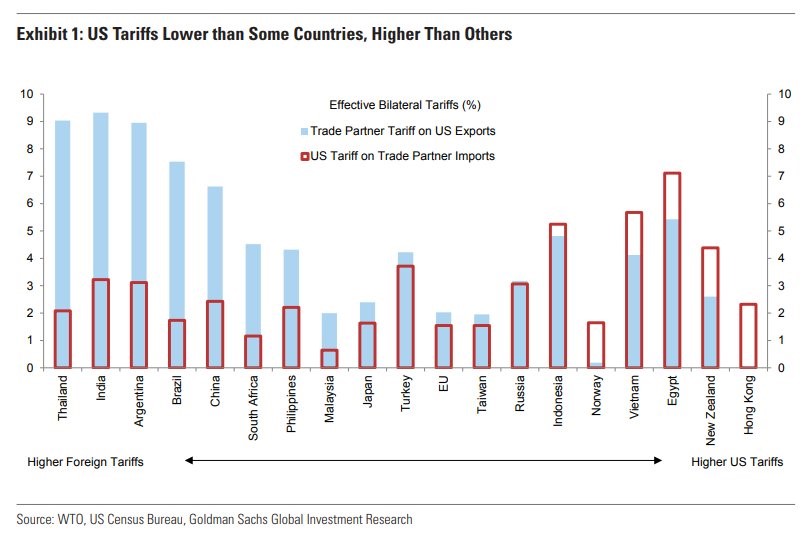

The chart below gives great context into what could happen. As you can see, it shows the trade partner tariffs on U.S. exports compared to U.S. tariffs on trade partner imports. I think the most likely scenario is the countries which have tariffs on American goods will see the biggest tariffs on their goods.

China might get higher tariffs if it doesn’t act to de-nuclearize North Korea. Ultimately, the situation is in the air. It’s not in Trump’s interest to tank the economy to end the trade deficit, so that won’t happen.

If Trump simply is bringing the American tariffs closer to what other countries have, it shouldn’t cause a trade war. I don’t even expect the U.S. to match China’s tariffs; they will just come closer, if they move at all.

When earnings growth is solid

As I mentioned, earnings growth will be in the double digits this year. That’s how stocks are valued, not based on the headlines.

I still discuss headlines because some could, in theory, affect the fundamentals. Also, it’s important to have an understanding how the market will look in the near term to get better entry points in long term positions or to help with swing trading if you do that.

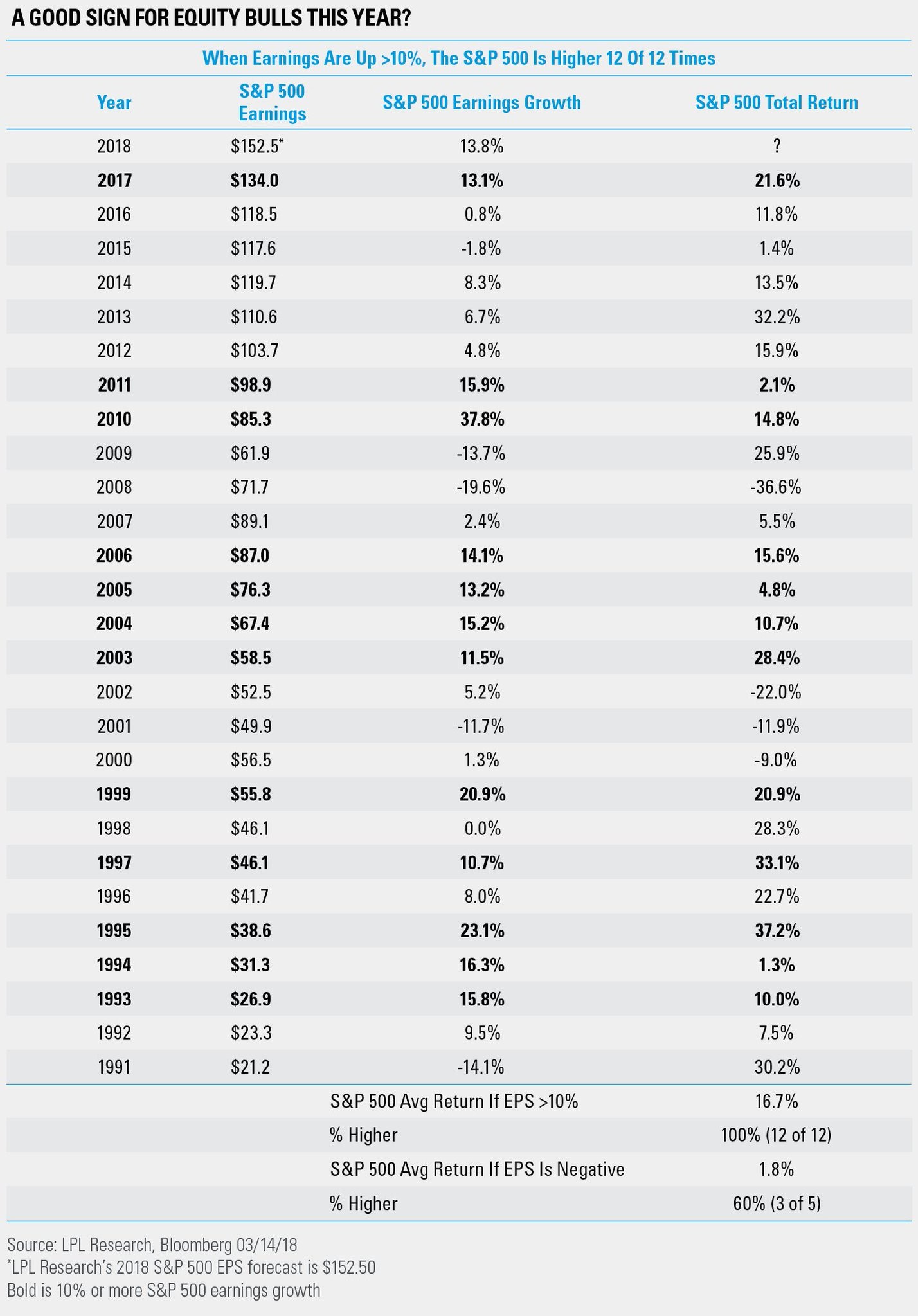

The table below shows earnings growth and total returns in every year since 1991. Since earnings growth is expected to be in the teens this year, this table shows the results when earnings growth is 10% or more. As you can see, the stock market has been up every time the earnings were up that much, with the average return being 16.7%.

There are 2 caveats to this table. The first one is it includes a pretty great time for stocks. From 1991 to 1999, the stock market was in its best bull market ever.

In 2009 to 2017, the stock market was in its second longest bull market since WWII. As you can see, stocks were actually up 3 out of 5 times EPS growth was negative.

I think it’s not reasonable to expect stocks to go up if earnings decline.

The second caveat is that this year is probably different from most other periods. The main reason why earnings growth will be in the double digits is because of the tax cuts. Therefore, it’s safe to say the earnings don’t reflect global economic growth as much as they usually do. It’s also worth noting the tax cuts may have been reflected in the stock returns in 2017.

I expect stocks to have a good year, but 16.7% in returns is probably unlikely. It’s also worth noting when earnings are growing, corrections only last a couple months until new highs are made.

Effect of tariffs on asset classes

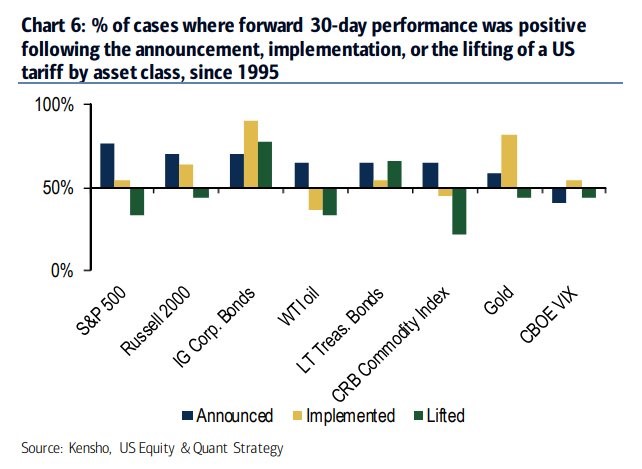

The chart below shows the performance of stocks, bonds, commodities, gold, and the CBOE Volatility Index (VIX) 30 days after tariffs are announced, implemented, and lifted. As you can see, the S&P 500 (SPX), Russell 2000 (RUT), investment grade corporate bonds, WTI oil, long term Treasury bonds, the CRB commodities index, and gold have all been up most of the time after tariffs are announced.

Obviously, all the tariffs from 1995 to the present didn’t lead to a trade war, just like these latest tariffs likely won’t.

Stocks have done the worst after the tariffs were lifted. I wouldn’t go as far as saying tariffs are a good thing for stocks. Rather, I would say there are many factors which effect stocks, panicking because of tariffs is a bad strategy.

Earnings growth ladder

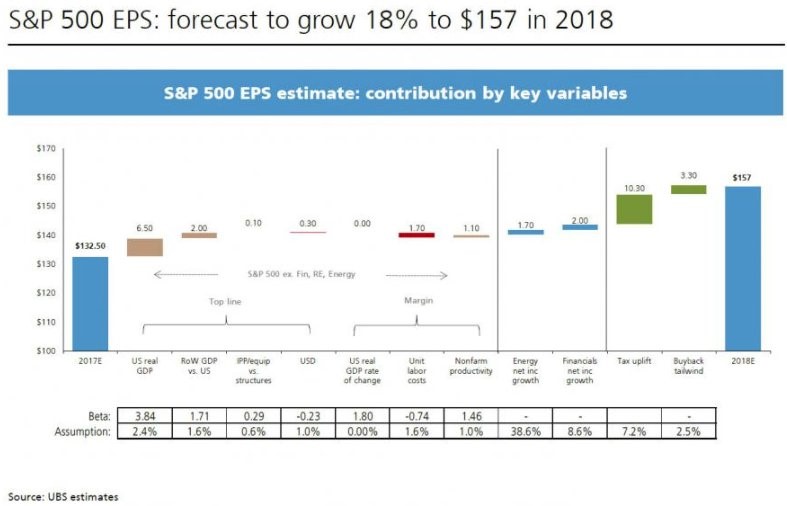

The chart below shows the variables which are leading to the 2018 earnings growth. As you can see, the tax uplift helps earnings growth the most by far.

The second biggest impact is real GDP growth. If it disappoints slightly, we could see earnings growth decline. The rest of the world GDP growth could also miss estimates.

I think the buybacks will beat estimates because a high percentage of the tax cuts will be spent on buybacks.

This chart shows the reason why I’m nervous about 2019 earnings estimates. This year is getting a pass because of the tax cuts, but next year won’t because of the tough comparison. When you add in a relatively hawkish Fed which is unwinding its balance sheet at $50 billion per year, you have a situation where double digit earnings growth is improbable.

Jobless claims data strong again

The labor market continues to be a source of strength as the initial claims fell 4,000 to 226,000 despite the terrible weather in the Northeast. I may have overestimated the effect of the storms, but we’ll need more data to understand their total impact.

I think the March BLS jobs report will be strong again because of these great results. Bulls should hope the labor participation rate increases in March to prevent high wage growth. That report will come after the next Fed meeting which is in 5 days.

Conclusion

I outlined the effect the tariffs could have on the market and contextualized the earnings growth in 2018.

Stocks should have a good year since earnings will grow in the double digits. The GDP growth in the first half of 2018 will probably be between 1.5% and 2.5%, making it a relatively normal period for this expansion. That’s somewhat disappointing because the momentum experienced in 2017 was supposed to be combined with the tax cuts to form the fastest growth of this cycle.