Global stocks prices have stalled after testing five-month highs yesterday, writes Bob Savage.

“Everything in moderation, including moderation.” – Oscar Wilde

Global stocks prices have stalled after testing five-month highs yesterday. There is a list of drivers behind this moderation. No one of them stands out and so it’s the size of the list of worries that matter as investors have to climb the wall to see another rally. China slipping from eight-month highs, the British pound is surging, these price stories aren’t extreme or surprising.

- Doubts about US-China trade deal return. The New York Times warns that Democrats will likely use a weak China deal against Trump in 2020 and that many Republicans are wary of a bad deal. Also, the Times reports, “many of the biggest sticking points still remain, including China’s state subsidization of companies, which gives Chinese firms a competitive advantage. Beijing also still appears to be falling short of the administration’s demands to stop what it says is a pattern of cyber theft and to end a requirement that American companies hand over valuable intellectual property as a condition of doing business there, people familiar with the negotiations said.”

- The odds for a no-deal Brexit went down again, but at the cost of UK Prime Minister Theresa May’s credibility. The prime minister will propose formally ruling out a no-deal Brexit in a bid to avoid a rebellion by lawmakers who are threatening to grab control of the divorce process, The Sun and Daily Mail newspapers reported.

- India air strike hits militant camp inside Pakistan. India claims 300 were killed in the raid on the JeM, the same group that killed 40 Indian police in the Kashmir on Feb 14. Intelligence that Jaish was planning more attacks led to the action.

- Irish Central Bank Chief Philip Lane – the next European Central Bank economist – plays down economic slowdown. Lane is the only candidate to replace Praet on the ECB Board in June. “I think it’s also fair to say that all of this is in the neighborhood of reasonably small adjustments to the forecasts,” Lane said in a confirmation hearing at the European Parliament’s Committee on Economic and Monetary Affairs in Brussels. “I think the current strategy can cater to limited downside revisions,” Lane said. “The forward guidance can accommodate revisions to the projections.”

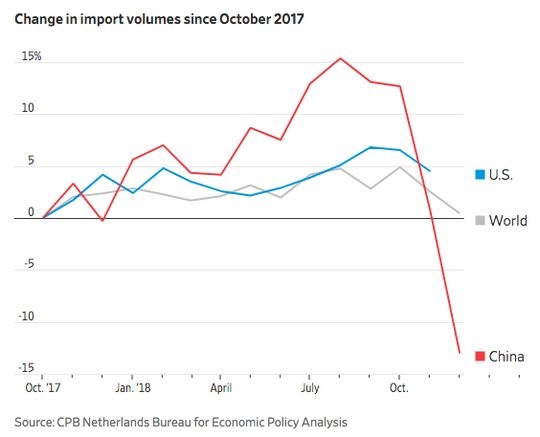

- Global trade slowdown in 2018 notable. The CPB Netherlands report on global trade yesterday maybe the best way to understand today’s price action. Total volume of goods for 2018 rose 3.3% down from 4.7% in 2017. Flows in 4Q 2018 were 0.9% down from the previous quarter, and China’s trade with the rest of the world accounted for most of the drop.

As we try to understand the hit of fear beating greed today, the barometer of the GBP matters as it’s clearly negatively correlated to the UK FTSE and it captures the risk of rate normalization against global trade. Watching 1.3250 for 1.34 and 1.36 test risk against 1.3200 pivot for 1.2850 again.

What is the real risk to global recession?

Today is about moods – comparing and contrasting the stable German consumer against the bouncing French mood and waiting for the U.S. conference board measure of the same. Throw in the reaction function of Chair Powell to the grim economic reports so far in February and you have some risk reduction afoot in the United States. But the United States isn’t alone in this moderation and the underlying focus is on bubbles. The Australian Central Bank rate cut hopes remain in play for the Aussie dollar today. The reason we should pay attention to the Australia housing bubble pop is because it’s on the front lines of a global problem post QE and the quantitative tightening of the FOMC.

The correlation of shrinking balance sheets and higher rates is obvious. The risk of the “wealth effect” hitting global consumers and growth regardless of the China feel-good-stimulus talk and the hopes for a U.S.-China trade deal are in balance. Australia is a good case study for the rest of the world as fiscal spending could help offset the gloom, as could a better trading environment, but the odds for a May rate cut from the Aussies are rising because of the housing story.