Given the intraday headline-driven volatility and the general uncertainty in the air, trading equities is getting hazardous, notes Joe Duarte.

Given the intraday headline-driven volatility and the general uncertainty in the air, trading this market is akin to walking across Niagara Falls on a tightrope on a windy day. Maybe it feels that way because we are in a period where once in a lifetime demographic and political changes are under way adding to daily anxiety. On the flip side, this constant change in the air may be a significant reason for corporate earnings to remain better than expected.

This is definitely a crazy bull market, hatched way back in 2009, which will surely usher in a bear market at some point. And it is clearly defying gravity. Moreover, if you review the economic statistics, you may conclude that the U.S. economy is slowing. The Fed certainly is cautious and has made it clear that interest rates are not going higher any time soon. The bond market, however, is pricing in a recession via its recent and highly publicized yield curve inversion.

So, who’s right and who’s wrong? The answer may be surprising.

Thinking Outside the Economic Box

Traditionally the U.S. economy has been fairly uniform, with most areas of the country generally trending in the same direction. Yet, this seems to be changing. In fact, the U.S. economy is now showing stark regional differences as a mega-population migration to areas of economic strength is changing everything.

The Fed’s February 2019 Beige Book, although overall describing most areas of the country as showing “mild to moderate growth” also reported stalling loan demand and weakening real estate in the New York district, falling loan demand in St. Louis, “signs of weakness” appearing in Minneapolis, along with “falling consumer spending” in Chicago. Perhaps the most ominous report came from Philadelphia where “business activity appeared to pause.”

Meanwhile, in Dallas: “Economic activity expanded moderately, with a slight pickup in demand seen across the manufacturing, services, and housing sectors. Drilling activity dipped. Hiring continued at a moderate pace, and employment outlooks were bullish. Input price pressures moderated but wage pressures remained elevated. Outlooks were more optimistic than the previous report.”

And while I can’t see the entire country, my daily observations mirror what the Fed says in the Beige Book. For example, I drive to and from work every day in a parking lot which used to be the I-635 freeway in Dallas. And there I see increasing numbers of license plates from Iowa, Illinois, California, New York, New Jersey, Pennsylvania, Florida, Mississippi, Missouri and even Canada. I see crowded parking lots at the big malls that are still standing, at restaurants and I see brisk traffic at big warehouses like Costco, Ulta, Best-Buy, Walmart and Sam’s.

My point is that the aggregate national economic figures may not be telling the whole story and that if you base your expectations of the future solely based on them, especially when it comes to corporate earnings, you could be disappointed.

Plainly stated, extraordinary numbers of people are moving from one place to another in the United States in what could be a once in a generation migration. And, as they move and resettle, they are creating economic activity by buying and renting homes, cars, along with products and services which may be making up for regional revenue and earnings shortfalls seen in places where the data is negative.

Thus, in order to gauge the real economic story, and develop a better earnings prediction model, traders must consider the regional trends and ask the big question: Are the strong regions, such as Texas and other southern states enough to keep the U.S. economy and corporate earnings growing? Maybe they are. And if so, that factor along with the Fed staying away from interest rate increases may be strong combination, which explains why stock prices keep rising. Maybe the algos know some stuff.

Bullet Train

- Calendar: U.S. markets will close for Good Friday. Earnings season picks up steam. Watch for earnings on IBM, NFLX, UNH, C, and GS to influence trading. Expect U.S. Industrial Production, Capacity Utilization and Manufacturing Production figures, U.S. Retail sales numbers releases. China releases GDP. OPEC will meet. U.S. Trade Balance and Markit PMI numbers for U.S. as well as Europe are expected. Several Fed speakers will be out on the talk circuit.

- Big Picture: The third year of the Presidential Cycle (2019) is traditionally bullish for stocks. The migration from high tax states to low tax states is an underappreciated economic factor.

- Risk: Watch earnings, the bond market, oil prices, and the U.S. border dispute. Keep a very close eye on U.S. China trade talks and the ongoing reserve ratio manipulations in China.

- Market Behavior: The trend remains up. Intraday volatility remains.

- What to do: Stay patient. Expect volatility. Think outside the box. Hedge when it’s called for but not excessively. Manage positions individually. Give stocks more room to maneuver by widening sell stops but sell if your stops get hit. Use options for high priced stocks.

The Trend in Stocks Remains Up

In what has become a habitual line in this section, the New York Stock Exchange Advance Decline line (NYAD) has made another high, which points to stock prices. This indicator remains the most accurate predictor of the stock market’s trend since the 2016 presidential election.

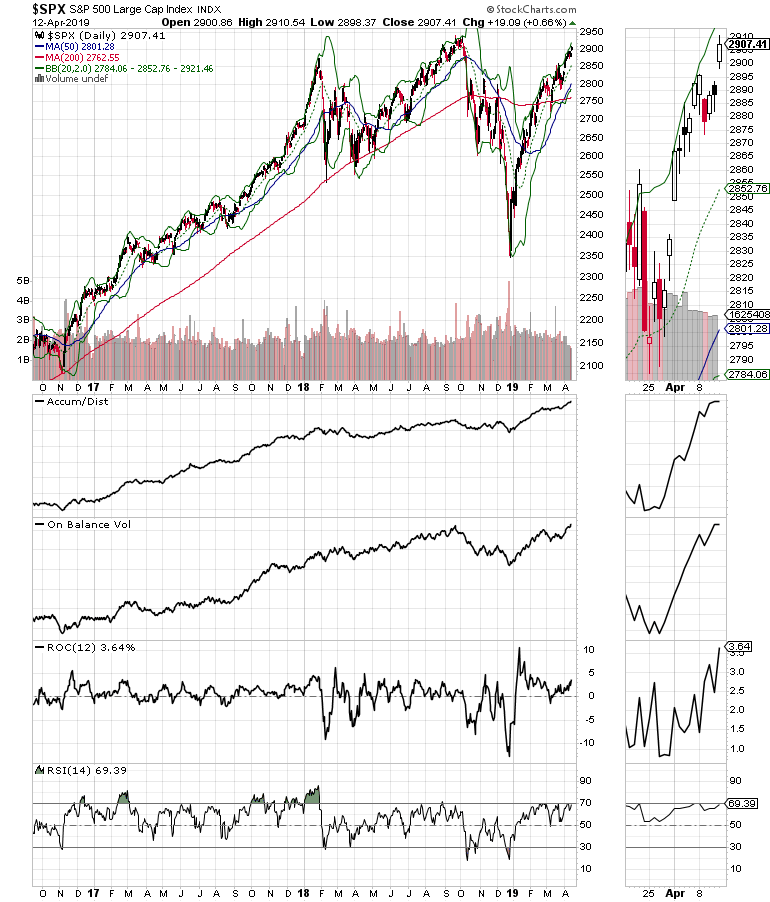

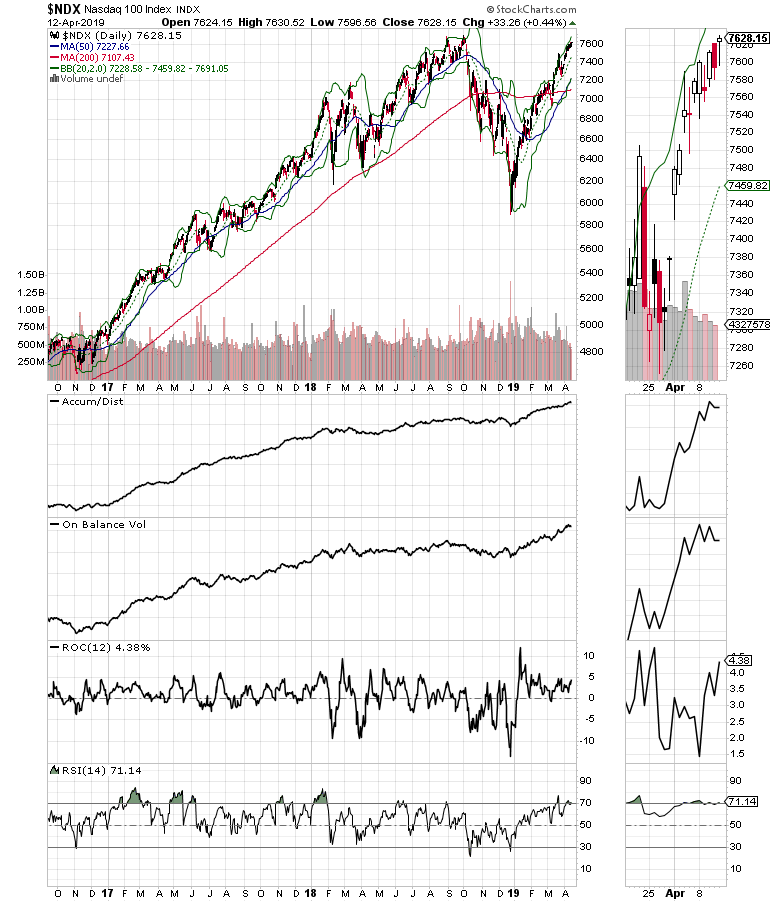

Both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes are now closing in on their all-time highs.

More important, the On Balance Volume (OBV), Accumulation Distribution (ADI), rate-of-change indicators are all positive and climbing. This suggests that money is moving back into stocks and is doing so at a more rapid pace, which means higher prices in the short term.

Sector selectivity remains important, with technology stocks such as Texas Instruments (TXN) and Cerus Logic (CRUS), two stocks in the Joe Duarte in the Money Options portfolio currently leading the way.

Trade with the Trend

As Marty Zweig would say, “don’t fight the Fed and don’t fight market momentum.”

We are in the middle of a major demographic and political shift which may be a stealth positive for corporate earnings, especially with the Federal Reserve standing aside. And stocks seem to like what they see. Of course, this is not a period without risk, as things could change with the next headline. Yet, from a trading standpoint there is clearly money to be made and those who can manage the risk can still participate.

Certainly, stocks are getting expensive, both on valuation and price metrics. But by using options, hedging when necessary, and remaining flexible in both your time frame and stock selection you can still participate in the overall market trend and decrease risks.

I own shares in CRUS and TXN as of this writing.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies.