Market volatility induced by macroeconomic factors has brought into question the resiliency of today’s retail option trader, states Garrett DeSimone of OptionMetrics.

The recent bear market has led to sustained losses for these traders across a variety of asset classes, likely reducing wealth along with risk tolerance.

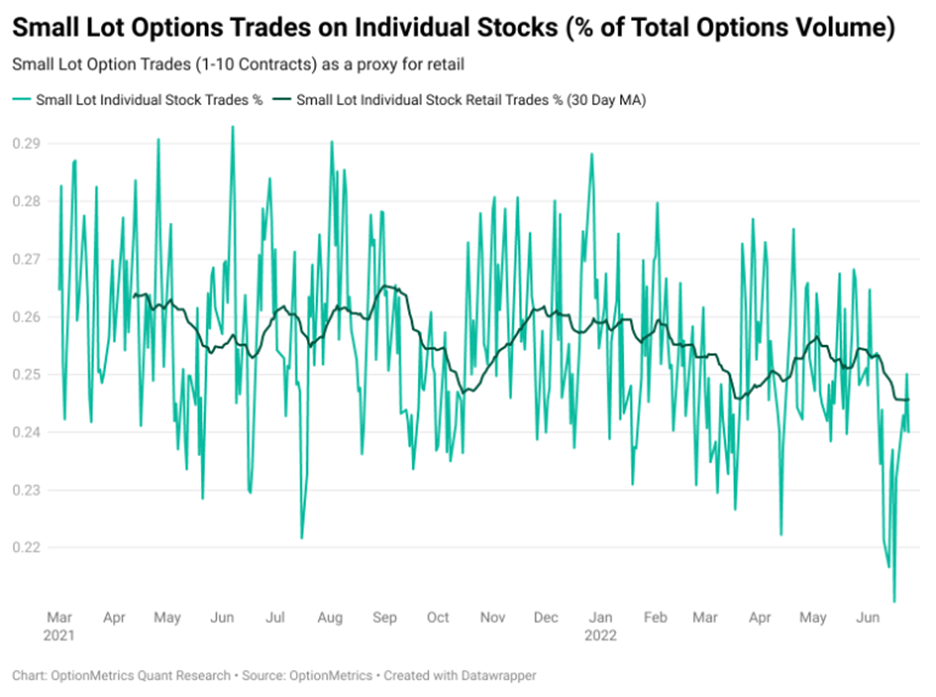

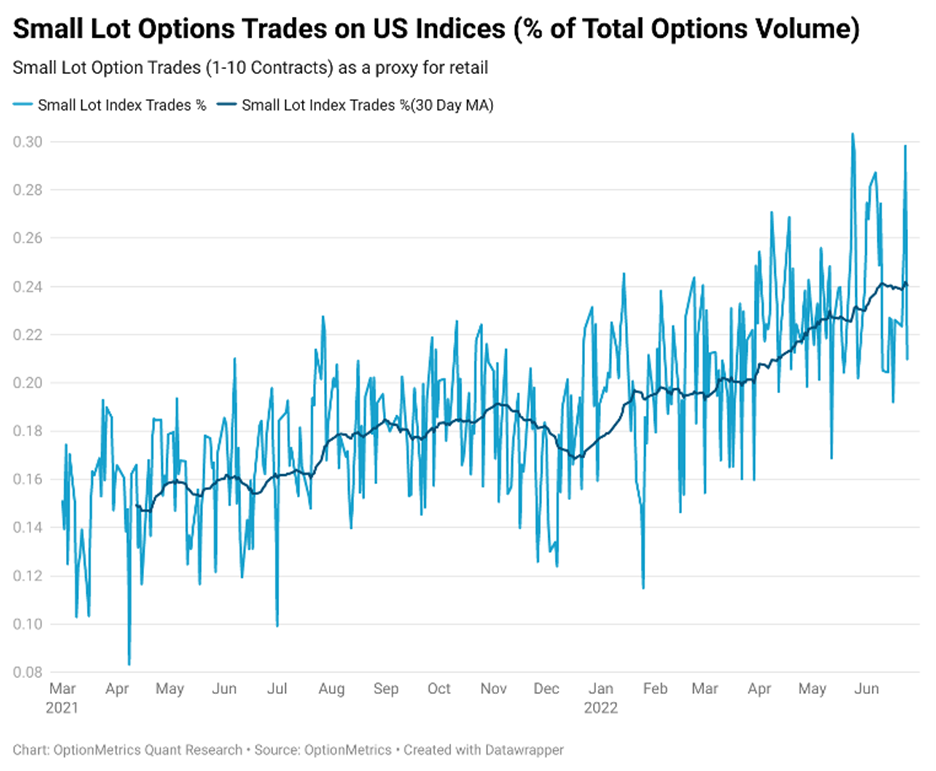

Smaller lot sizes tend to be more likely in retail option trading. OptionMetrics proxies for retail behavior by studying small lot trade sizes on options data within IvyDB Signed Volume.

We decided to examine this data to gain insights into retail option traders’ resiliency given recent events.

Graph One demonstrates the percentage of small lot trades for all single stock options. The percentage of small lot trades has decreased from 26% in January 2022 to 24.5% by the end of June. It appears retail traders have retreated from the market, albeit slightly.

However, we find that this dynamic changes when retail trades are analyzed on US indices. Graph Two depicts the percentage of small lot size trades on US index options. Retail activity has steadily increased in index options from 18% in Jan 2022 to over 24% in June.

What has driven this change in preferences?

One possible catalyst is a retail shift from speculative call buying in single name to broader portfolio hedging via puts. In a bear market environment, long out-of-the-money call trades can quickly become losers. However, retail traders may be trying to capitalize on puts, which may perform better during downturns.

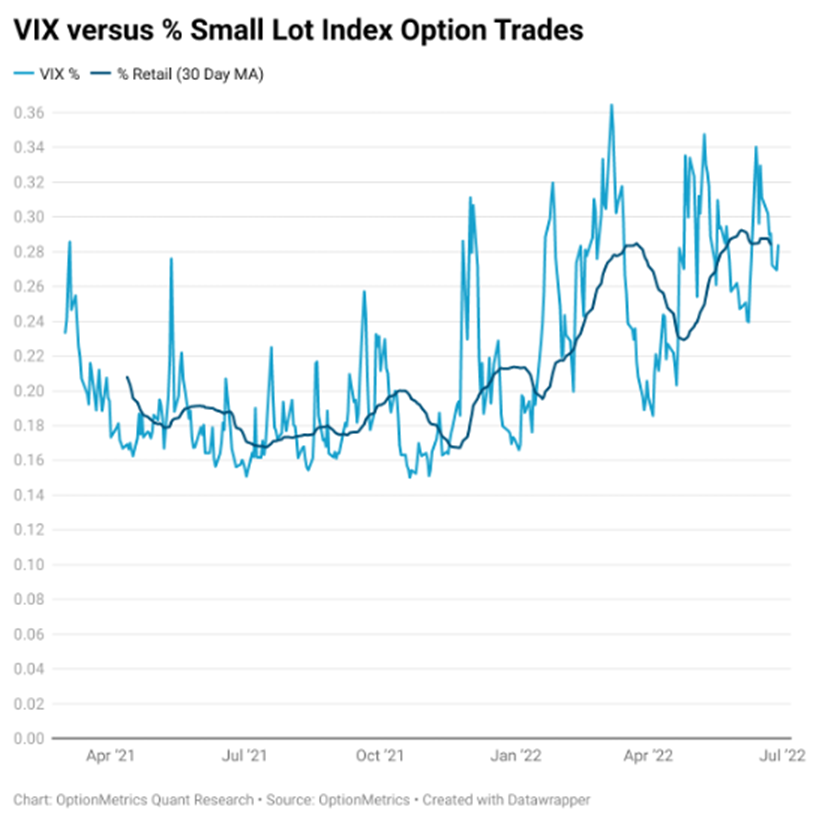

Graph Three plots the relationship between the COBE SPX Volatility Index (VIX) level and the percentage of small lot index trades moving average (MA). The moving average is a smoothing technique, calculated by averaging the rolling previous 30 trading sessions. The VIX level and percentage of small lot trades have increased in tandem since the start of January.

If the VIX is a barometer for uncertainty, then the above data and insights would seem to indicate that retail investors have piled into index options as broader economic news surrounding inflation has garnered significant attention.

It appears retail activity hasn’t evaporated but rather shifted.

Garrett DeSimone, PhD, is Head of Quantitative Research at OptionMetrics, LLC. His company is an options database and analytics provider for institutional and retail investors and academic researchers that has covered every US strike and expiration option on over 10,000 underlying stocks and indices since 1996.