Matthew Kerkhoff, options expert and editor of Dow Theory Letters, concludes his 14-part educational series on understanding options and their role in investment portfolios. Our sincerest thanks to Matt for sharing his insights and knowledge to help our readers understand the world of options.

If you missed any of the prior installments or just want a quick refresher, they’re linked below.

Part 1 and 2: Understanding Put Options

Part 3: Understanding Put Options

Part 4: Factors that Affect Options Prices

Part 5: Portfolio Insurance (Part 1)

Part 6: Portfolio Insurance (Part 2)

Part 7: Rent out Your Stocks for Income (Part 1)

Part 8: Rent out Your Stocks for Income (Part 2)

Part 9 and 10: How to Get Paid to Buy Stocks

Part 11 and 12: How to Get Paid to Buy Stocks

Part 13: How to Make Money Even When You're Wrong

In the last installment, we began discussing our most complex strategy so far, vertical spreads. This strategy combines two options (either two puts or two calls) to create a position that allows us to profit under a wide variety of outcomes.

One of the unique aspects of vertical spreads is that they can be used in both bullish and bearish environments. In other words, unlike the previous strategies we’ve discussed that tend to be directional, vertical spreads can be used to make bets in either direction.

Earlier this month we walked through a hypothetical trade where we made a bullish bet on Apple (AAPL). Let’s see how that trade worked out; then I’ll show you how we can use calls (instead of puts) to create a vertical spread with a bearish outlook.

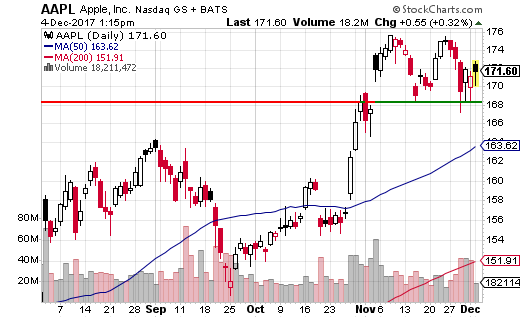

To refresh your memory, we had previously looked at this chart of Apple, and determined it was most likely that AAPL would head higher in the coming weeks, or at the very least, not drop below recent support near $168.

By selling the $167.50 strike put, and buying a $165 strike put, we were able to create a trade that would deliver a max profit of $44 as long as AAPL remained above $167.50 per share at expiration – which was last Friday.

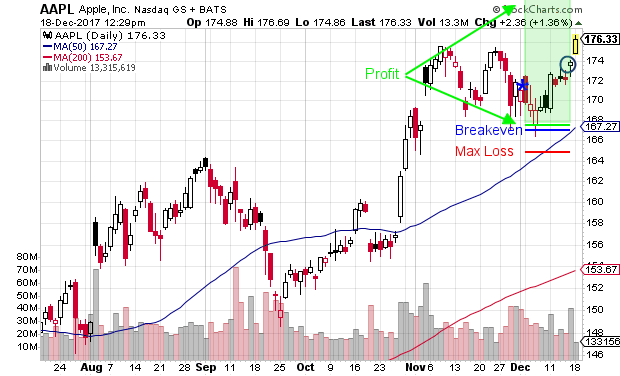

Let’s see how AAPL behaved over that time, and if our trade turned out to be profitable. In the chart below we can see the latest price action.

The first thing to notice is that AAPL closed at $173.97 last Friday (small blue circle), which means that both of our option contracts expired worthless. As a result, we get to keep the $44 credit that we received when we entered the trade (on December 4th) and we have no resulting liability based on the put that we sold (the $167.50 strike).

This is the ideal way these types of trades play out, and if done properly, this strategy can have a win rate near 75 – 80%. This is a result of the wide variety of outcomes that still result in our achieving our maximum profit.

In the chart above, I’ve included three lines (green, blue, and red) to help visually identify the parameters of our trade. I’ve also included a small blue asterisk to denote the day and price level at which we entered this trade.

Notice that from the blue asterisk forward, we had a lot of room for AAPL to move (both up and down) before we would begin to see our max profit erode:

- As long as AAPL remained ANYWHERE above the green line at $167.50 (the higher strike put that we sold) we achieved max profit.

- Below the green line and above the blue line, our trade would still be profitable.

- Below the blue line and above the red line we would experience a loss.

- Below the red line we would experience our maximum potential loss of $206.

So as you can see, as long as we didn’t get the direction of AAPL completely wrong, this trade had a good chance of being profitable. AAPL could go up, and we’d make money; AAPL could stay flat, and we’d make money; and even if APPL went down by a small amount, our trade would still profitable.

Now admittedly, $44 is not much profit in the grand scheme of things, but remember that we only put $250 of capital at risk (actually it was only $206 since we received the $44 in income, but for the purposes of calculating a return we’ll go with the $250).

So based on the capital required to execute this trade, we earned a return of 17.6% ($44/$250) in just 11 days. Had we wanted to earn that return on more capital, we simply would have increased the number of puts that we bought and sold …

If we had sold two $167.50 strike puts and bought two $165 puts, it would have resulted in us receiving $88 in premium and a maximum potential liability of $500. Make sense? The more capital we want to invest, the more contracts we purchase and sell.

All right, now let’s talk about closing out these types of positions.

In a situation like this, because both options that were part of this trade expired worthless, there was nothing we had to do to close out the position. As mentioned, any options that expire worthless will simply be removed from our account following expiration.

But if one or both of these positions were in-the-money at expiration (AAPL had fallen somewhere below $167.50 per share), then we would need to close out this vertical spread prior to expiration. Luckily, closing out a vertical spread is as simple as opening one, and is accomplished by reversing the transactions we previously made.

FREE 14-part guide to options: The Basics to In-Depth Portfolio Strategies

In this case, we would be purchasing the $167.50 strike that we had initially sold, and selling the $165 strike that we initially bought. We would do this as part of one transaction (just as we did to open the trade), and in this way we would “settle” any losses that we did have on the position.

Because this strategy results in a defined-loss scenario, we knew from the very beginning that the most we could lose on this trade was $206. Even if AAPL had collapsed during the time of our trade and was below $165 per share at expiration, closing out our position could never cost us more than $250.

This is because even if we were forced to purchase 100 shares of AAPL at $167.50 (per the terms of the put contract we initially sold), we could turn around and resell those 100 shares for $165 (per the terms of the put contract that we initially bought). So no matter what happened to APPL, we never would have had to pay more than $250 (plus commission) to exit this trade.

Vertical spreads can be extremely lucrative and are one of my favorite types of options trades. What makes them especially valuable is that you can use them in any type of market.

As we wrap things up I’d like to end by showing you a quick example of how this strategy can be used to make a bearish bet instead of a bullish one. Recall from the last article that credit spreads (vertical spreads that result in a net credit to your account) come in two varieties:

1. Bear call option credit spread – a neutral or bearish option spread that uses calls to establish the position.

2. Bull put option credit spread – a neutral or bullish option spread that uses puts to establish the position.

In the example we just walked through, we used a bull put option credit spread to make a bullish to neutral bet on AAPL. But let’s say that now, because AAPL has rallied strongly, we want to make the reverse bet. What would that look like?

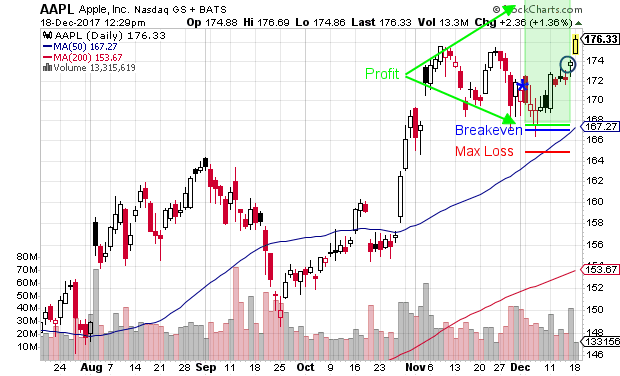

First, here’s another look at the price action in APPL.

If we thought AAPL was likely to either move lower over the next month or remain near its current price, we could create a bearish vertical spread by using call options.

Here’s what the current option chain looks like. Notice in this case that we are looking at calls, not puts.

I don’t want to spend a lot of time on this, as there will be no follow up (and this isn’t a trade I’d recommend anyway, since we’re essentially fighting both the primary bullish trend in the market and the inherent bullish trend in AAPL) but I do want to show you how this strategy can work in both directions.

If we decided to sell the $180/$182.50 vertical call spread outlined above in yellow, we would receive a credit to our account of $80 (half way point between the bid and ask prices).

Here is the what the resulting profit and loss scenario would look like:

- As long as AAPL stays below $180 through expiration in January (32 days from now), we will receive our max profit of $80.

- If AAPL trades above $180 at expiration, then our profit will begin to erode until AAPL reaches a share price of $180.80, which is our breakeven share price.

- If we get the direction of AAPL totally wrong, and AAPL trades above $180.80 at expiration, then we will begin to incur losses until our max loss is reached at a share price of $182.50. In this case our max loss is also $250. (Actually, our max loss is really just $170, because we would get to keep the $80 in premium income we received to enter the trade.)

So as you can see, this trade is almost identical to the first one we made, just in the opposite direction.

The ability to use vertical spreads in all market conditions (bullish, bearish, and flat), combined with their limited-loss nature, is what makes them a truly incredible strategy.

I know that the idea of using two options together adds complexity, but if you can master vertical spreads, you’ll have a very unique advantage that will put you ahead of most other investors.

I really hope that you’ve enjoyed this series over the past year. Even if you never trade a single option in your life, at least now you have a better understanding of what’s possible in the world of options, and some of the strategies that other investors are using to manage their portfolios.

The decision to create this series was made based on requests from subscribers and we would appreciate your feedback in helping us understand how much attention to give this topic moving forward.

As always, thanks for reading!