Germany has excessive stimulus, asserts Don Kaufman, Co-Founder of TheoTrade. And in the US, what are the economic impacts of hurricanes Harvey and Irma?

Get Trading Insights, MoneyShow’s free trading newsletter »

In a previous article, we discussed the ECB’s decision to not raise rates until 2019 as it starts to further taper QE in 2018 before thinking about raising rates. The fact that Draghi said in his last meeting that he was willing to add more QE if the economy falters is remarkable because he’s already done way too much.

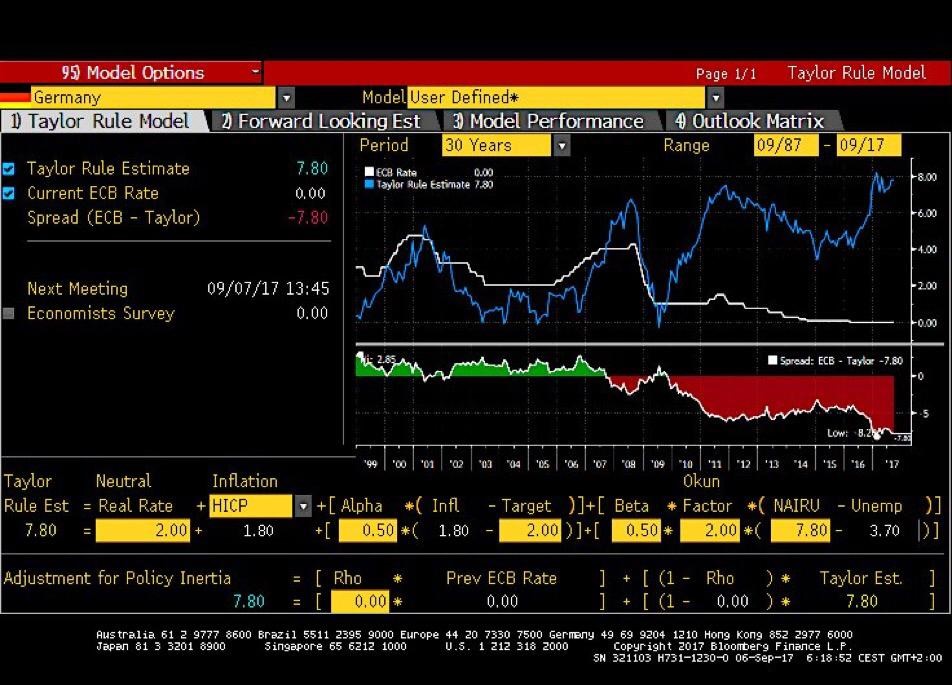

The chart below looks the Taylor Rule using German economic data. It compares what the Taylor Rule sales interest rates should be to the ECB’s interest rate.

Unsurprisingly, the gap between the Taylor Rule and the ECB rate is enormous. The ECB rate is at zero while the German unemployment rate is 3.70%. The ECB rate is lower than the Fed funds rate while the U.S. unemployment rate is higher. The level of stimulus pumped into the economy is unprecedented and wreaks of desperation. Draghi isn’t in control by saying he’ll do whatever it takes; he’s out of control as he tries to pull out all the stops to get the economy to grow.

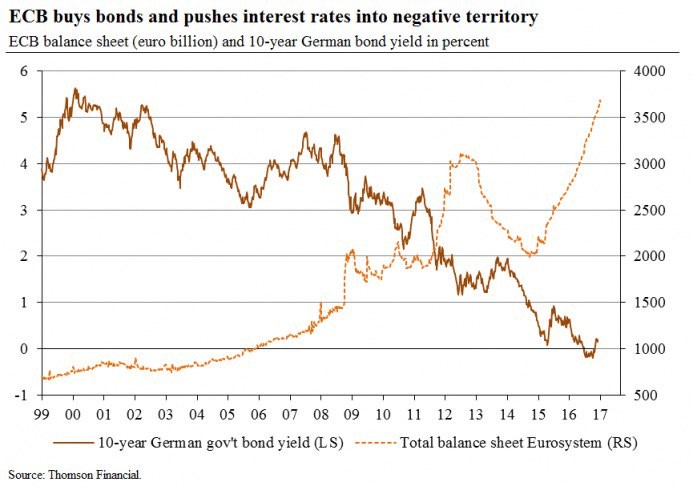

The excessive stimulus pushed into the economy has led to the death cross seen in the chart below. The 10-year German bund yield has fallen near zero as the ECB has expanded its balance sheet to about 4 trillion euros. The unintended consequences of zero percent interest rates are vast as businesses have adjusted to a new normal which is artificial.

Advertisement

I don’t expect the end of the stimulus to be like 2013-2015 where the balance sheet declined. Officials have explained when it’s over, the balance sheet will be maintained, shrinking only on a GDP basis as GDP continues to grow.

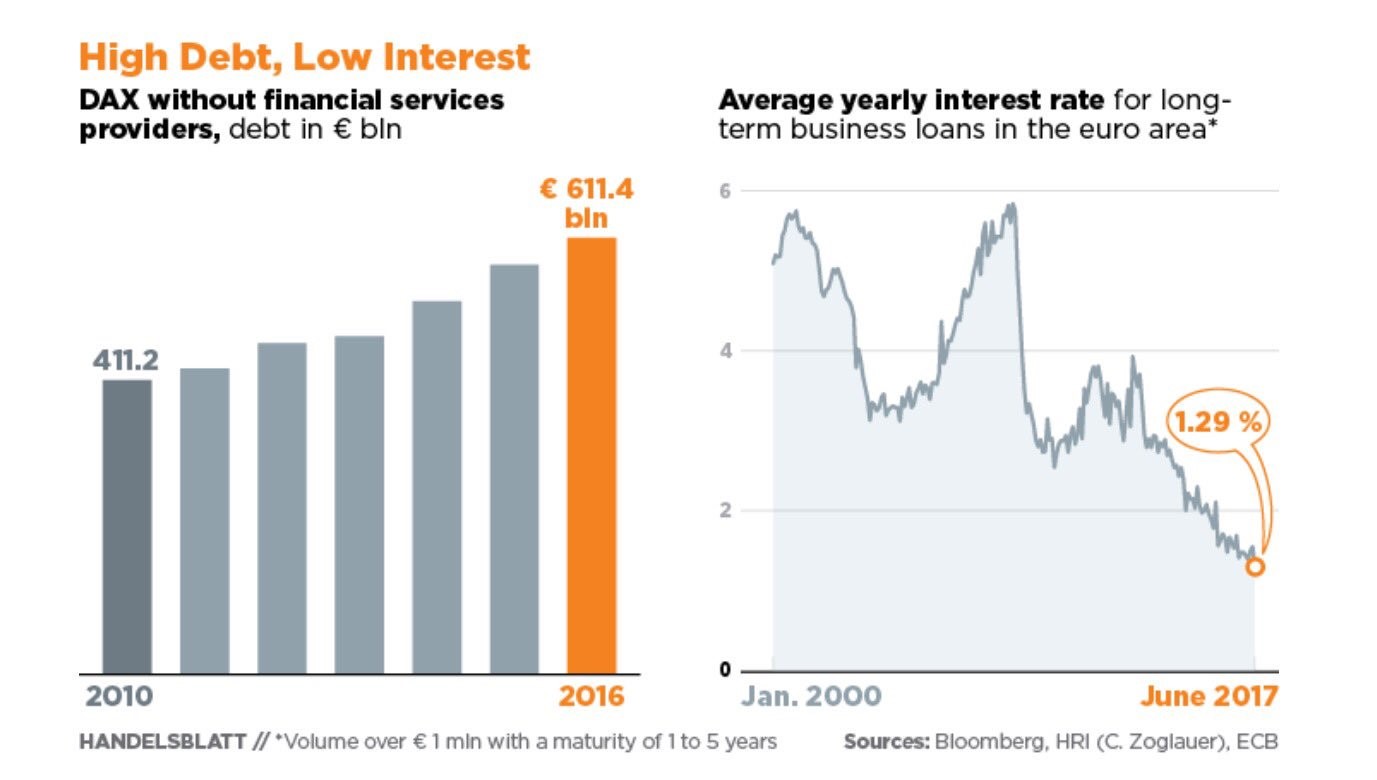

The charts below show the situation which has been created in Germany. The debt DAX firms have has increased by almost 50% from 2010 to 2016.

As you can see from the chart on the right, the long-term interest rate for businesses has fallen to almost 1%. When a business has access to unlimited capital, bone headed decisions are made which cause companies to go bust. While you may stand from afar and think that a company wouldn’t take out excessive loans in a temporarily low-interest rate environment, take a look at the acquisitions made at any oil cycle peak to see why that’s an incorrect thought process.

Businesses buy smaller firms with the thought process that oil prices will stay high for the long term. Management teams feel the pressure of improving shareholder value. The increased debt in the past few years likely will put many companies in a bind if interest rates were to increase because firms don’t expect that to happen.

US economic news

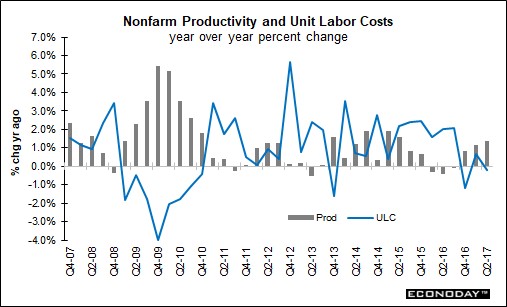

This recovery has been mostly lacking productivity growth. It has been the big sticking point which has prevented this economic recovery from gaining steam. The productivity and unit labor cost reports were released Thursday.

As you can see from the chart below, unit labor costs declined year over year, while the productivity growth rate accelerated. On a quarter over quarter seasonally adjusted annual run rate basis, productivity growth was 1.5% which was the high end of the consensus range.

This improvement in productivity allowed this year’s GDP growth to improve from last year. The increased productivity growth allows unit labor cost to fall as firms get more out of their workers. The quarter over quarter seasonally adjusted annualized growth rate in unit labor costs was 0.2%. This throws off the theory that the labor market is tight. It’s weird to see unit labor costs growing slower now than when the unemployment rate was higher and there was more slack in the labor market.

While some bears can construe this as negative because they say it proves the labor market isn’t tight, this is a big positive because it shows productivity can prevent wage inflation from getting out of hand.

Speaking of the labor market, the jobless claims report was released on Thursday. While this occurs every week, this report is the first economic metric which includes results from the period where Hurricane Harvey hit.

As you can see from the chart, like I expected, the initial jobless claims spiked. They increased to 298,000 which is a 26% spike week over week. That’s the biggest increase since 2012 and the biggest percentage increase since 2005.

This is the highest jobless claims since April 2015 as it almost ended the streak of weeks below 300,000. From this 62,000 increase, 51,6637 jobless claims came from Texas which was a 95.6% week over week increase. The weakness from the Texas storm might cause the September payrolls report to swing to a negative.

The unemployment rate in Houston was 4.9% in July 2017. If that were to also increase 95.6% the unemployment rate would be up 4.7% to 9.6%. With the Houston area having 4.673 million jobs, that would cause a 220,000 impact. The average BLS non-farm payrolls this year showed 176,000 jobs created, which means the September report will likely be negative.

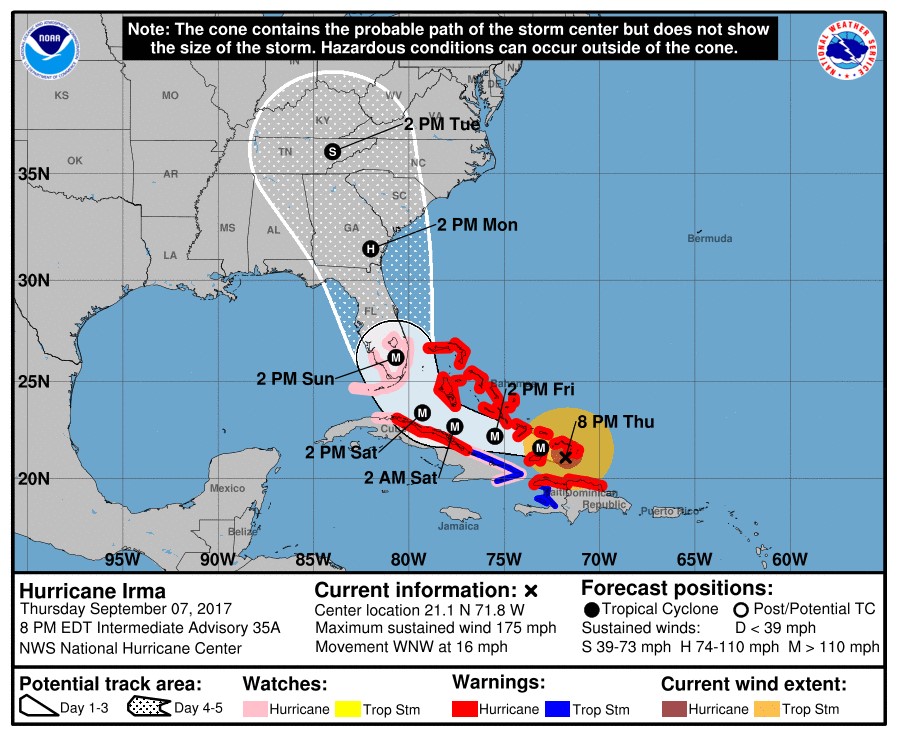

That economic impact ignores Hurricane Irma which will likely cause weakness which will also be included in the jobs report. As you can see from the forecast map below, landfall hit Sunday with the largest impact the Florida Keys and Southwest Florida. Miami isn’t as big of a city as Houston. Houston is the 4th largest city in America with over 2 million people while Miami is the 44th biggest city with 440,000 people. That being said the impact won’t be limited to Miami, so it will still have a large economic impact.

Conclusion

There’s a large difference between the Taylor Rule for Germany and where the ECB has rates. This hyperstimulation will have unintended consequences. On the bright side for the U.S. economy, productivity growth improved. Unfortunately, much of the southeast is storm ravaged which means the standard of living for millions of people fell instead of improving at a quicker clip. We’re just getting the economic effects for Harvey in Texas and Irma doing equal or greater damage to Florida.