In this edition of Volume Analysis, we’re taking a sidebar from our usual discussion around capital market flows to focus on Federal Reserve policy and the bond markets, explains Buff Dormeier of Kingsview Partners.

As a Chartered Market Technician, I focus on investors’ behaviors and how those behaviors interrelate across asset classes. This practice is called intermarket analysis. In this publication, we apply intermarket analysis of the debt markets, as I believe the bond market is the horse (bonds) pulling the kart (stock market).

You might be asking, why the fundamental change to focus on bonds now?

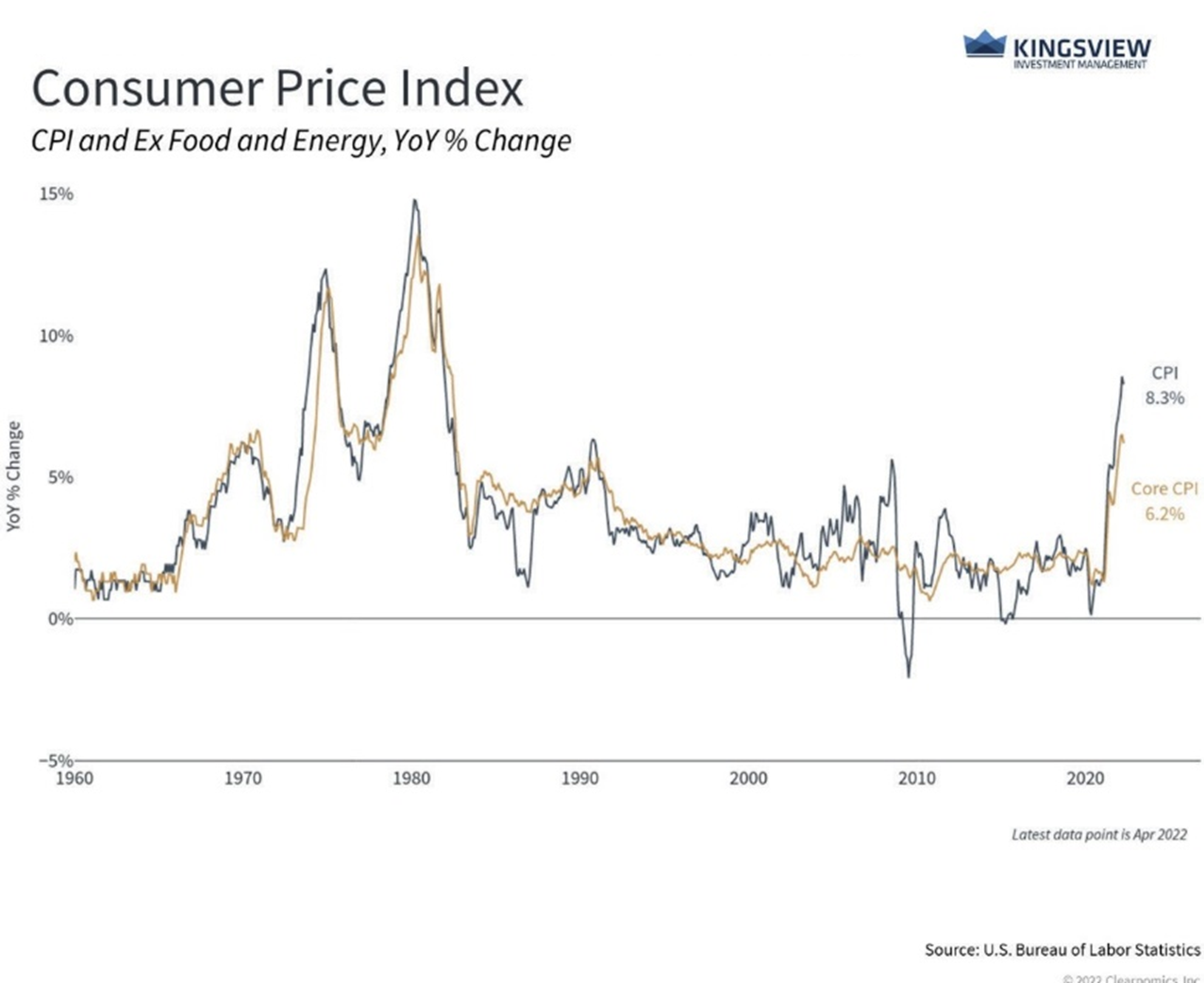

Because this is a new market cycle of radical change, something you are already well aware of, as it is reflected in your daily life activities in the form of inflation. Inflation now sits at its highest level in 40 years.

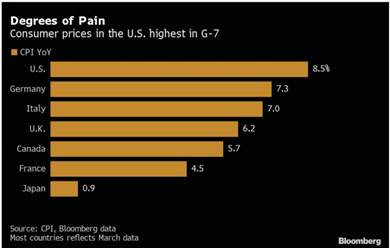

Although inflation is mostly a worldwide phenomenon, the United States has the highest inflation of all developed markets. Something is fundamentally different now compared to the last few decades, especially here in the United States.

Chart 1: Consumer Price Index

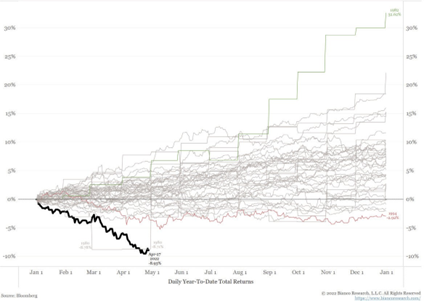

As a result, the aggregate bond market has experienced an epic decline. In late April, it was down nearly 9% for the calendar year 2022. This is the worst recorded loss on record for aggregate bonds.

With yields still historically low compared to other periods of inflation, more risks could be expected in this asset class.

Chart 2: Degrees of Pain

Inflation also impacts stocks. With the threat of higher inflation, the US stock market is off to its worst start of a calendar year in 34 years, as measured by maximum drawdowns. Inflation has caused both bonds and stocks to fall, leading to the worst quarterly (first quarter 2022) return in 42 years among the common asset classes (defined as small, mid, and large-cap equities and fixed income).

Chart 3: Bloomberg US Aggregate Total Return Index

Specifically, last quarter’s best common asset was large-cap stocks, which lost over 4%. It is an extremely rare occurrence that none of the common asset classes are up. You will need to go back to 1980 to find a common best asset class down more than last quarter (first quarter 2022).

Make no mistake; inflation is the culprit.

For the last three decades, bonds have been used as a safe haven or counterbalance to falling equities. But during inflationary cycles, bonds and stocks have historically been correlated. Thus, the traditional balanced portfolio approach of owning debt and equity has been failing investors during this inflationary cycle. And unfortunately, I am not looking for an end to inflation anytime soon.

That is because the Federal Reserve appears to be way behind the inflationary curve. To move ahead of the inflationary curve, the Federal Funds rate needs to be above the Consumer Price Index.

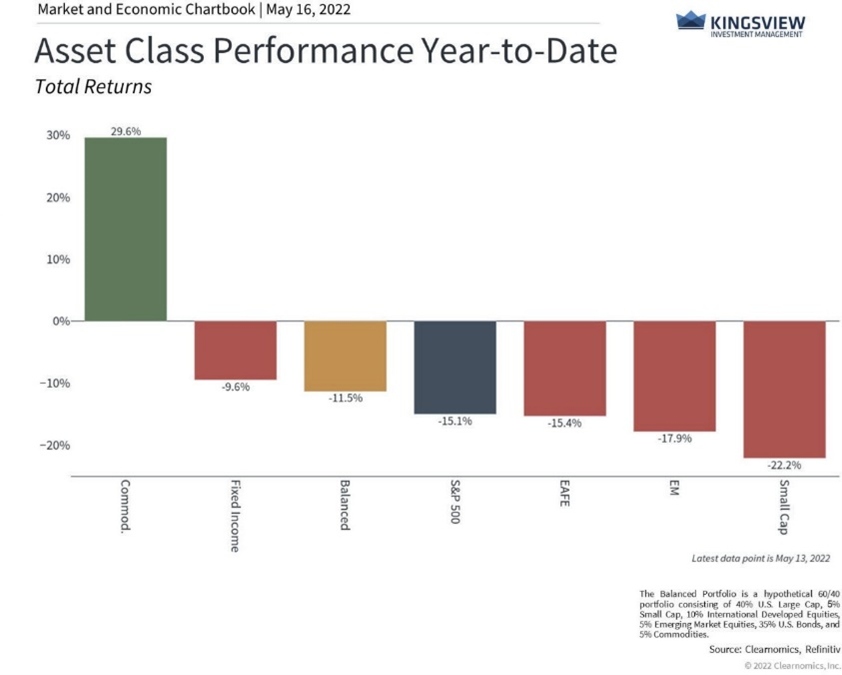

Chart 4: Asset Class Performance (YTD)

With the CPI at 8.3% and the Federal Funds rate at only 1%, the Federal Reserve policy remains accommodative to inflation. To be neutral, either inflation has to come down massively or short-term interest rates need to rise profoundly above present expectations—or some combination of both.

Inflation begets inflation. It is circular in nature, and too many dollars chasing fewer goods creates inflation. Once prices begin to accelerate, the cost of production, transportation, storage, and wages all rise. These increasing costs cause end prices to rise even more, and the cycle builds upon itself like a snowball rolling downhill.

The Federal Reserve knows one way to stop this vicious cycle is to slow economic growth.

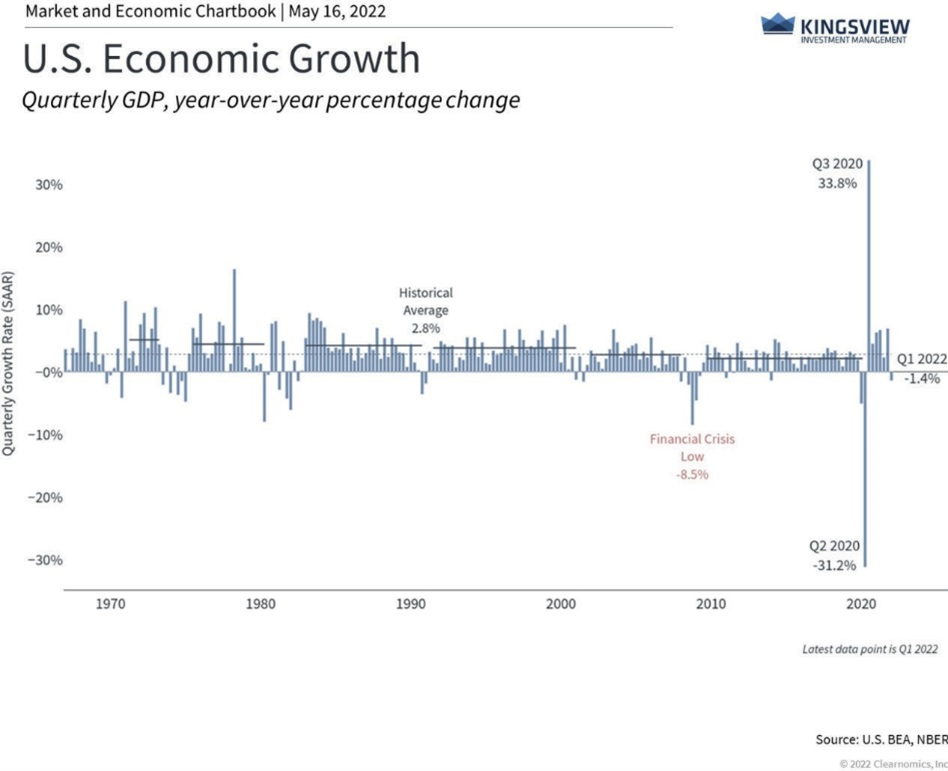

That has already started with the first-quarter GDP coming in at a negative 1.4%. An economy with falling economic growth plus high inflation is called stagflation, one of the most feared economic states, where wealth is destroyed.

Chart 5: US Economic Growth

Yet, most economists and financial analysts still do not believe that the Federal Reserve is willing to destroy the economy or the markets to tame inflation. Many of these same experts believed inflation to be transitory, and over 40% of financial analysts still hold to this belief even now.

And who could blame them for thinking it’s the Federal Reserve’s job to bail them out? Since the 2000 deflationary bear market, the Federal Reserve has acted as the white knight to equities. If I were to choose one group as a contrary indicator, it would be economists, because they have been consistently wrong on their bond market forecasts.

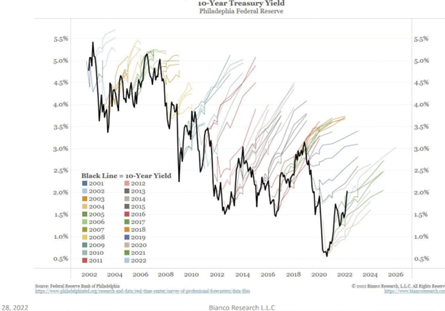

For example, during the last several decades, the Bloomberg Survey of Economists shows a very strong bias of the ten-year rate rising in the future. Meanwhile, bonds during this same period experienced a steadily persistent fall in interest rates.

Chart 6: Survey of Professional Forecasters

And where are they now?

For the first time since the survey was established, the economists’ consensus is that ten-year interest rates will remain relatively flat.

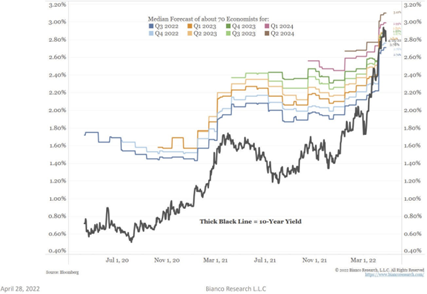

Additionally, there is a survey of Federal Funds rate predictions.

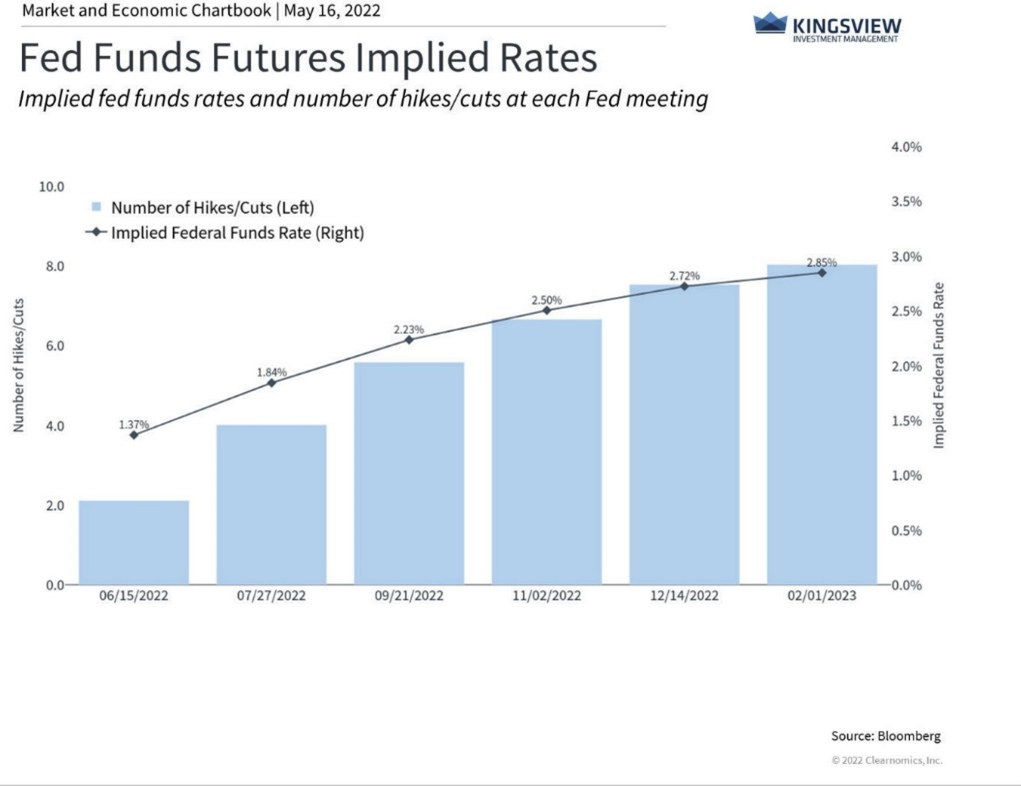

Economists believe the Fed will raise rates to 2%, whereas the Federal Funds futures, which are the actual bets from professional managers, believe Federal Funds rates will rise to 2.85% in less than a year.

As you know, my approach is to follow the money, not the noise. In other words, do what they do, not what they say.

Chart 7: 10-Year Treasury Note Yield and Forecasts

I have three additional reasons for holding a contrary opinion about the Federal Reserve’s willingness to help tank the economy in order to tame inflation. The Federal Reserve has just two official mandates. One is to keep inflation low and in control. They are utterly failing here. The word transitory has become mud in their face.

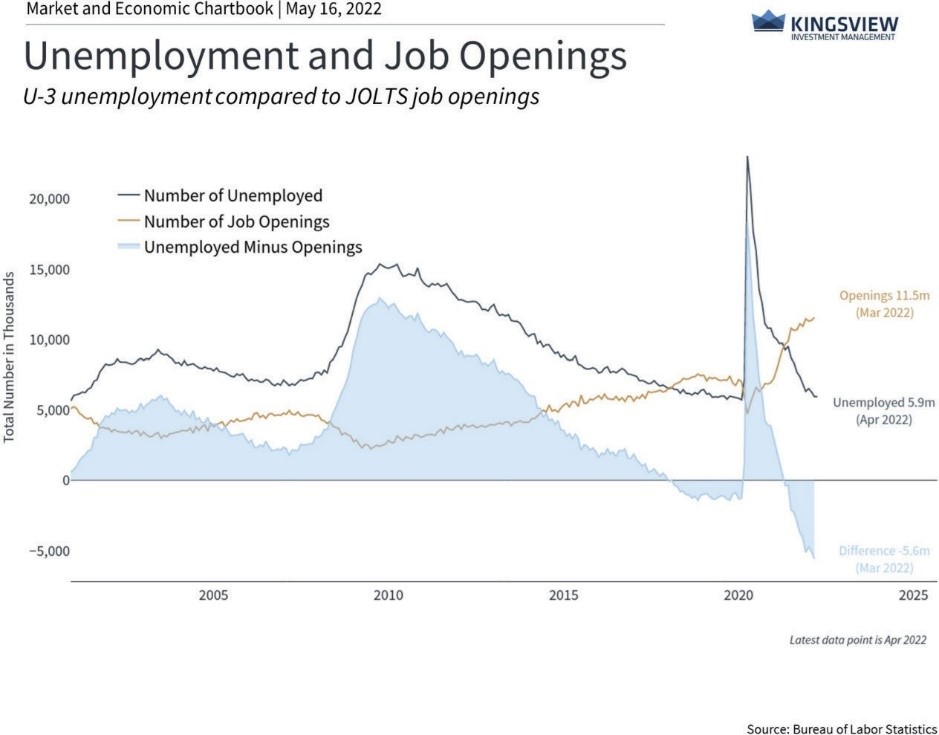

Two, they strive to keep employment full. They are wildly succeeding in that respect. Presently, unemployment is down to 5.9 million Americans actively looking for work.

Meanwhile, the number of available jobs is 11.5 million, which means the Federal Reserve has a large buffer of 5.6 million jobs over job seekers. Thus, they may be able to stall the economy and still maintain their full employment objectives. A weakening economy could allow them to accomplish their dual mandate of fighting inflation and unemployment.

Chart 8: Fed Funds Futures Implied Rates

Chart 9: Unemployment and Job Openings

Second, The Federal Reserve is fully aware of the impact of inflation on our citizens. The median wage of the average US worker is 52K per year, and the average cost of a home in 2021 was 375K. Last year, inflation caused the average price of a home to increase by 54k.

For the first time in history, the average American’s home produced more wealth than their work. That’s good for those owning real estate, but unfortunately, 40% of Americans do not own a home. And on average, 35% of Americans have less than $1000 in savings.

For these groups of Americans, inflation means significant hardship. In other free societies, sustained falling levels of real income (wages minus inflation) have at times led to public insurrection. Considering the current popularity of the social justice movement, the Federal Reserve will likely not tolerate those with equity and hard assets seemingly benefiting from inflation while those without wealth suffer the consequences.

The third reason comes from market technician Jim Bianco, CMT, who said, “The great thing about Fed Governors are the ones who just left the organization because they don’t read talking points that were handed to them but tell you what they think.” To that point, on April sixth, former Fed Governor Bill Dudley on Bloomberg said, “If stocks don’t fall, the Fed needs to force them.” If Bianco’s thesis is correct, that statement tells us two things.

One, the Federal Reserve really is in the business of manipulating asset prices (stocks). This theory has been continually denied by the Fed but is commonly accepted by market participants. And two, they plan on doing their part in bringing stock prices down to curb inflationary pressures. With that, let me remind you of a quote I provided in March of 2020 from another technician, Marty Zweig. “Don’t fight the Fed.” This time the quote has the opposite ramifications.

In previous periods of falling asset prices/deflation, lowering rates, building its balance sheet, and repurchase agreements were the tools employed by the Fed. But going back to our original theme that inflation is a game-changer, I believe this time is different because those tools cause inflation while stimulating the economy. The Federal Reserve is dead set on fighting inflation at the expense of and perhaps even the goal of depreciating asset prices. With inflation as opposed to deflation, they are now doing the opposite, raising rates and reducing their balance sheet.

I believe this investing climate favors tactical management. Strategies that diversify risk solely between debt and equity may not work well with high inflation. In an inflationary environment, hard assets should benefit. These include businesses, especially those that are generating high free cash flow.

With high inflation, growth investments may not be viewed as favorable on discounted cashflow basis. However, cash-cow businesses with present high earnings may be deemed more favorable given high expected inflation. In investment environments like these which we are currently experiencing, we cannot stress enough the importance of employing a risk-managed approach.

All the best my friends!

Learn more about Buff Dormeier here.